[](http://okama.readthedocs.io/)

[](https://www.python.org/)

[](https://pypi.org/project/okama/)

[](https://coveralls.io/github/mbk-dev/okama?branch=master)

[](https://opensource.org/licenses/MIT)

[](https://colab.research.google.com/github/mbk-dev/okama/blob/master/examples/01%20howto.ipynb)

[](https://github.com/psf/black)

# Okama

_okama_ is a library with investment portfolio analyzing & optimization tools. CFA recommendations are used in quantitative finance.

_okama_ goes with **free** «end of day» historical stock markets data and macroeconomic indicators through API.

>...entities should not be multiplied without necessity

>

> -- <cite>William of Ockham (c. 1287–1347)</cite>

## Table of contents

- [Okama main features](#okama-main-features)

- [Financial data and macroeconomic indicators](#financial-data-and-macroeconomic-indicators)

- [End of day historical data](#end-of-day-historical-data)

- [Macroeconomic indicators](#macroeconomic-indicators)

- [Other historical data](#other-historical-data)

- [Installation](#installation)

- [Getting started](#getting-started)

- [Documentation](#documentation)

- [Financial Widgets](#financial-widgets)

- [RoadMap](#roadmap)

- [Contributing to okama](#contributing-to-okama)

- [Communication](#communication)

## Okama main features

- Investment portfolio constrained Markowitz Mean-Variance Analysis (MVA) and optimization

- Rebalanced portfolio optimization with constraints (multi-period Efficient Frontier)

- Investment portfolios with contributions / withdrawals cash flows (DCF)

- Monte Carlo Simulations for financial assets and investment portfolios

- Popular risk metrics: VAR, CVaR, semi-deviation, variance and drawdowns

- Different financial ratios: CAPE10, Sharpe ratio, Sortino ratio, Diversification ratio

- Forecasting models according to normal, lognormal and other popular distributions

- Testing distribution on historical data

- Dividend yield and other dividend indicators for stocks

- Backtesting and comparing historical performance of broad range of assets and indexes in multiple currencies

- Methods to track the performance of index funds (ETF) and compare them with benchmarks

- Main macroeconomic indicators: inflation, central banks rates

- Matplotlib visualization scripts for the Efficient Frontier, Transition map and assets risk / return performance

## Financial data and macroeconomic indicators

### End of day historical data

- Stocks and ETF for main world markets

- Mutual funds

- Commodities

- Stock indexes

### Currencies

- FX currencies

- Crypto currencies

- Central bank exchange rates

### Macroeconomic indicators

For many countries (China, USA, United Kingdom, European Union, Russia, Israel etc.):

- Inflation

- Central bank rates

- CAPE10 (Shiller P/E) Cyclically adjusted price-to-earnings ratios

### Other historical data

- Real estate prices

- Top bank rates

## Installation

`pip install okama`

The latest development version can be installed directly from GitHub:

```python

git clone https://github.com/mbk-dev/okama@dev

poetry install

```

## Getting started

### 1. Compare several assets from different stock markets. Get USD-adjusted performance

```python

import okama as ok

x = ok.AssetList(['SPY.US', 'BND.US', 'DBXD.XFRA'], ccy='USD')

x # all examples are for Jupyter Notebook/iPython. For raw Python interpreter use 'print(x)' instead.

```

Get the main parameters for the set:

```python

x.describe()

```

Get the assets accumulated return, plot it and compare with the USD inflation:

```python

x.wealth_indexes.plot()

```

### 2. Create a dividend stocks portfolio with base currency EUR

```python

weights = [0.3, 0.2, 0.2, 0.2, 0.1]

assets = ['T.US', 'XOM.US', 'FRE.XFRA', 'SNW.XFRA', 'LKOH.MOEX']

pf = ok.Portfolio(assets, weights=weights, ccy='EUR')

pf.table

```

Plot the dividend yield of the portfolio (adjusted to the base currency).

```python

pf.dividend_yield.plot()

```

### 3. Draw an Efficient Frontier for 2 popular ETF: SPY and GLD

```python

ls = ['SPY.US', 'GLD.US']

curr = 'USD'

last_date='2020-10'

# Rebalancing periods is one year (default value)

frontier = ok.EfficientFrontierReb(ls, last_date=last_date, ccy=curr, rebalancing_period='year')

frontier.names

```

Get the Efficient Frontier points for rebalanced portfolios and plot the chart with the assets risk/CAGR points:

```python

import matplotlib.pyplot as plt

points = frontier.ef_points

fig = plt.figure(figsize=(12,6))

fig.subplots_adjust(bottom=0.2, top=1.5)

frontier.plot_assets(kind='cagr') # plots the assets points on the chart

ax = plt.gca()

ax.plot(points.Risk, points.CAGR)

```

<nowiki>*</nowiki> - *rebalancing period is one year*.

### 4. Get a Transition Map for allocations

```python

ls = ['SPY.US', 'GLD.US', 'BND.US']

map = ok.EfficientFrontier(ls, ccy='USD').plot_transition_map(x_axe='risk')

```

More examples are available in form of [Jupyter Notebooks](https://github.com/mbk-dev/okama/tree/master/examples).

## Documentation

The official documentation is hosted on readthedocs.org: [https://okama.readthedocs.io/](https://okama.readthedocs.io/)

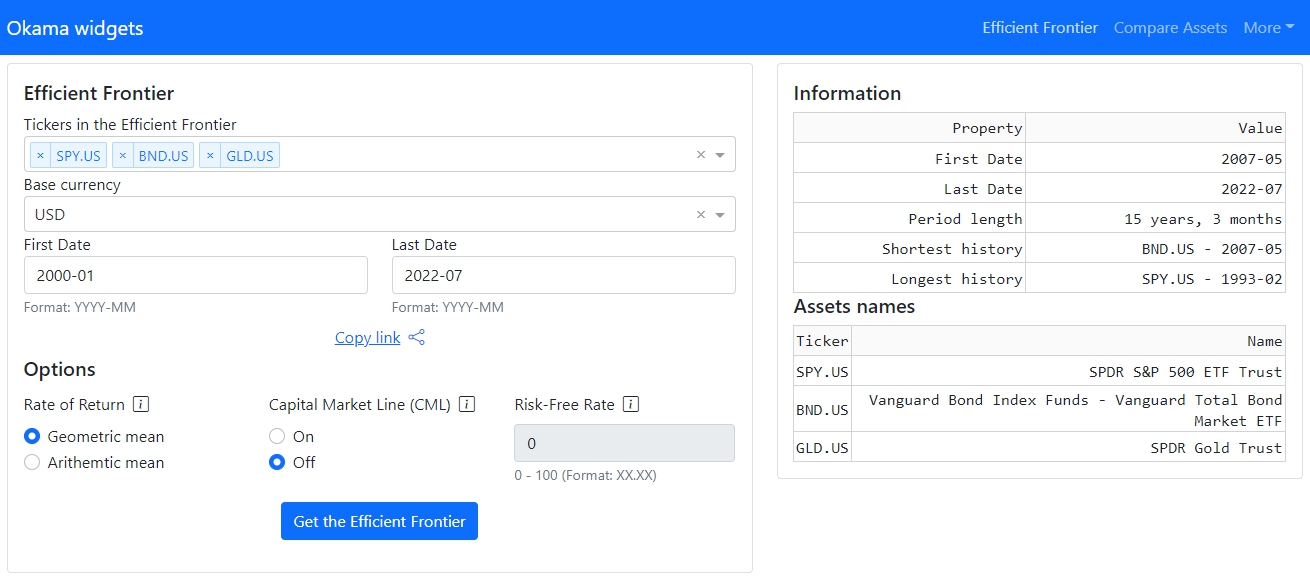

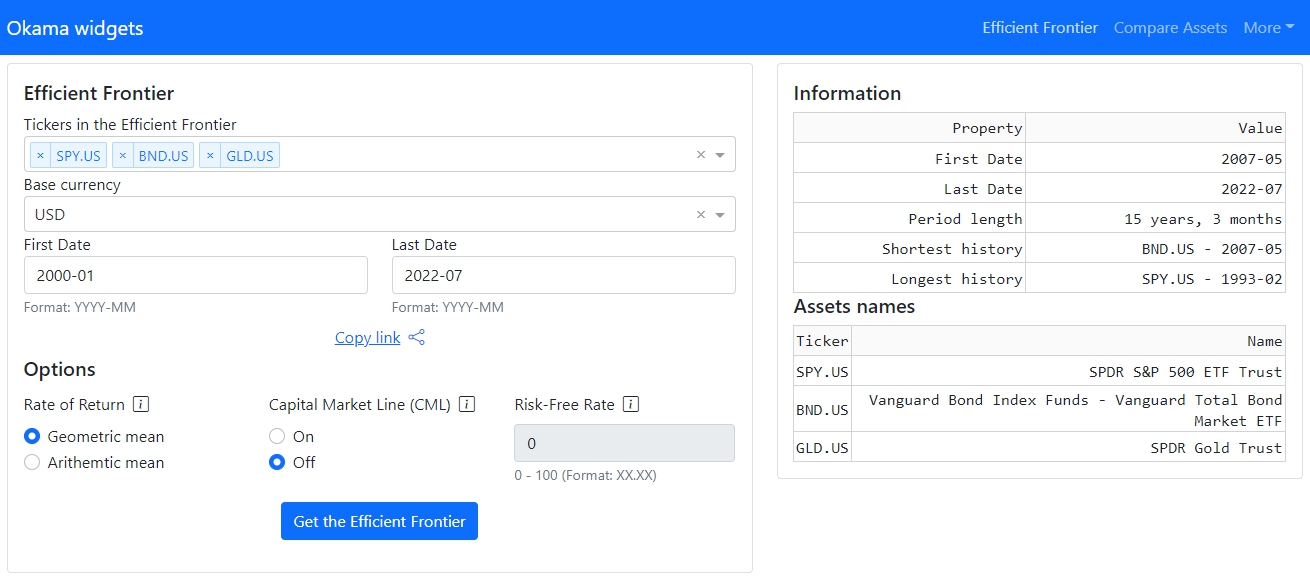

## Financial Widgets

[okama-dash](https://github.com/mbk-dev/okama-dash) repository has interactive financial widgets (multi-page web application)

build with _okama_ package and [Dash (plotly)](https://github.com/plotly/dash) framework. Working example is available at

[okama.io](https://okama.io/).

## RoadMap

The plan for _okama_ is to add more functions that will be useful to investors and asset managers.

- Add Omega ratio to EfficientFrontier, EfficientFrontierReb and Portfolio classes.

- Make complex withdrawals / contributions strategies in Portfolio class.

- Make complex portfolio rebalancing strategies.

- Add Black-Litterman asset allocation

- Accelerate optimization for multi-period Efficient Frontier: minimize_risk and maximize_risk methods of EfficientFrontierReb class.

- Make a single EfficientFrontier class for all optimizations: single-period or multu-period with rebalancing period as a parameter.

- Add different utility functions for optimizers: IRR, portfolio survival period, semi-deviation, VaR, CVaR, drawdowns etc.

- Add more functions based on suggestion of users.

## Contributing to okama

Contributions are *most welcome*. Have a look at the [Contribution Guide](https://github.com/mbk-dev/okama/blob/master/CONTRIBUTING.md) for more.

Feel free to ask questions on [Discussuions](https://github.com/mbk-dev/okama/discussions).

As contributors and maintainers to this project, you are expected to abide by okama' code of conduct. More information can be found at: [Contributor Code of Conduct](https://github.com/mbk-dev/okama/blob/master/CODE_OF_CONDUCT.md)

## Communication

For basic usage questions (e.g., "_Is XXX currency supported by okama?_") and for sharing ideas please use [GitHub Discussions](https://github.com/mbk-dev/okama/discussions/3).

Russian language community is available at [okama.io forums](https://community.okama.io).

## License

MIT

Raw data

{

"_id": null,

"home_page": "https://okama.io",

"name": "okama",

"maintainer": null,

"docs_url": null,

"requires_python": "<4.0.0,>=3.9",

"maintainer_email": null,

"keywords": "finance, investments, efficient frontier, python, optimization",

"author": "Sergey Kikevich",

"author_email": "chilango74@gmail.com",

"download_url": "https://files.pythonhosted.org/packages/e5/b2/606863f98852368984b5b3df02477ae94ff3d9332d561ff87554c30559c3/okama-1.4.4.tar.gz",

"platform": null,

"description": "\n[](http://okama.readthedocs.io/)\n[](https://www.python.org/)\n[](https://pypi.org/project/okama/)\n[](https://coveralls.io/github/mbk-dev/okama?branch=master)\n[](https://opensource.org/licenses/MIT)\n[](https://colab.research.google.com/github/mbk-dev/okama/blob/master/examples/01%20howto.ipynb)\n[](https://github.com/psf/black)\n\n# Okama\n\n_okama_ is a library with investment portfolio analyzing & optimization tools. CFA recommendations are used in quantitative finance.\n\n_okama_ goes with **free** \u00abend of day\u00bb historical stock markets data and macroeconomic indicators through API.\n>...entities should not be multiplied without necessity\n>\n> -- <cite>William of Ockham (c. 1287\u20131347)</cite>\n\n## Table of contents\n\n- [Okama main features](#okama-main-features)\n- [Financial data and macroeconomic indicators](#financial-data-and-macroeconomic-indicators)\n - [End of day historical data](#end-of-day-historical-data)\n - [Macroeconomic indicators](#macroeconomic-indicators)\n - [Other historical data](#other-historical-data)\n- [Installation](#installation)\n- [Getting started](#getting-started)\n- [Documentation](#documentation)\n- [Financial Widgets](#financial-widgets)\n- [RoadMap](#roadmap)\n- [Contributing to okama](#contributing-to-okama)\n- [Communication](#communication)\n\n## Okama main features\n\n- Investment portfolio constrained Markowitz Mean-Variance Analysis (MVA) and optimization\n- Rebalanced portfolio optimization with constraints (multi-period Efficient Frontier)\n- Investment portfolios with contributions / withdrawals cash flows (DCF)\n- Monte Carlo Simulations for financial assets and investment portfolios\n- Popular risk metrics: VAR, CVaR, semi-deviation, variance and drawdowns\n- Different financial ratios: CAPE10, Sharpe ratio, Sortino ratio, Diversification ratio \n- Forecasting models according to normal, lognormal and other popular distributions\n- Testing distribution on historical data\n- Dividend yield and other dividend indicators for stocks\n- Backtesting and comparing historical performance of broad range of assets and indexes in multiple currencies\n- Methods to track the performance of index funds (ETF) and compare them with benchmarks\n- Main macroeconomic indicators: inflation, central banks rates\n- Matplotlib visualization scripts for the Efficient Frontier, Transition map and assets risk / return performance\n\n## Financial data and macroeconomic indicators\n\n### End of day historical data\n\n- Stocks and ETF for main world markets\n- Mutual funds\n- Commodities\n- Stock indexes\n\n### Currencies\n\n- FX currencies\n- Crypto currencies\n- Central bank exchange rates\n\n### Macroeconomic indicators\nFor many countries (China, USA, United Kingdom, European Union, Russia, Israel etc.): \n\n- Inflation\n- Central bank rates\n- CAPE10 (Shiller P/E) Cyclically adjusted price-to-earnings ratios\n\n### Other historical data\n\n- Real estate prices\n- Top bank rates\n\n## Installation\n\n`pip install okama`\n\nThe latest development version can be installed directly from GitHub:\n\n```python\ngit clone https://github.com/mbk-dev/okama@dev\npoetry install\n```\n\n\n## Getting started\n\n### 1. Compare several assets from different stock markets. Get USD-adjusted performance\n\n```python\nimport okama as ok\n\nx = ok.AssetList(['SPY.US', 'BND.US', 'DBXD.XFRA'], ccy='USD')\nx # all examples are for Jupyter Notebook/iPython. For raw Python interpreter use 'print(x)' instead.\n\n```\n \n\nGet the main parameters for the set:\n```python\nx.describe()\n```\n \n\nGet the assets accumulated return, plot it and compare with the USD inflation:\n```python\nx.wealth_indexes.plot()\n```\n \n\n### 2. Create a dividend stocks portfolio with base currency EUR\n\n```python\nweights = [0.3, 0.2, 0.2, 0.2, 0.1]\nassets = ['T.US', 'XOM.US', 'FRE.XFRA', 'SNW.XFRA', 'LKOH.MOEX']\npf = ok.Portfolio(assets, weights=weights, ccy='EUR')\npf.table\n```\n \n\nPlot the dividend yield of the portfolio (adjusted to the base currency).\n\n```python\npf.dividend_yield.plot()\n```\n \n\n### 3. Draw an Efficient Frontier for 2 popular ETF: SPY and GLD\n```python\nls = ['SPY.US', 'GLD.US']\ncurr = 'USD'\nlast_date='2020-10'\n# Rebalancing periods is one year (default value)\nfrontier = ok.EfficientFrontierReb(ls, last_date=last_date, ccy=curr, rebalancing_period='year')\nfrontier.names\n```\n \n\nGet the Efficient Frontier points for rebalanced portfolios and plot the chart with the assets risk/CAGR points:\n```python\nimport matplotlib.pyplot as plt\n\npoints = frontier.ef_points\n\nfig = plt.figure(figsize=(12,6))\nfig.subplots_adjust(bottom=0.2, top=1.5)\nfrontier.plot_assets(kind='cagr') # plots the assets points on the chart\nax = plt.gca()\nax.plot(points.Risk, points.CAGR) \n```\n \n<nowiki>*</nowiki> - *rebalancing period is one year*.\n\n### 4. Get a Transition Map for allocations\n```python\nls = ['SPY.US', 'GLD.US', 'BND.US']\nmap = ok.EfficientFrontier(ls, ccy='USD').plot_transition_map(x_axe='risk')\n```\n \n\nMore examples are available in form of [Jupyter Notebooks](https://github.com/mbk-dev/okama/tree/master/examples).\n\n## Documentation\n\nThe official documentation is hosted on readthedocs.org: [https://okama.readthedocs.io/](https://okama.readthedocs.io/)\n\n## Financial Widgets\n[okama-dash](https://github.com/mbk-dev/okama-dash) repository has interactive financial widgets (multi-page web application) \nbuild with _okama_ package and [Dash (plotly)](https://github.com/plotly/dash) framework. Working example is available at \n[okama.io](https://okama.io/).\n\n \n\n## RoadMap\n\nThe plan for _okama_ is to add more functions that will be useful to investors and asset managers.\n\n- Add Omega ratio to EfficientFrontier, EfficientFrontierReb and Portfolio classes.\n- Make complex withdrawals / contributions strategies in Portfolio class.\n- Make complex portfolio rebalancing strategies.\n- Add Black-Litterman asset allocation \n- Accelerate optimization for multi-period Efficient Frontier: minimize_risk and maximize_risk methods of EfficientFrontierReb class.\n- Make a single EfficientFrontier class for all optimizations: single-period or multu-period with rebalancing period as a parameter.\n- Add different utility functions for optimizers: IRR, portfolio survival period, semi-deviation, VaR, CVaR, drawdowns etc.\n- Add more functions based on suggestion of users.\n\n## Contributing to okama\n\nContributions are *most welcome*. Have a look at the [Contribution Guide](https://github.com/mbk-dev/okama/blob/master/CONTRIBUTING.md) for more. \nFeel free to ask questions on [Discussuions](https://github.com/mbk-dev/okama/discussions). \nAs contributors and maintainers to this project, you are expected to abide by okama' code of conduct. More information can be found at: [Contributor Code of Conduct](https://github.com/mbk-dev/okama/blob/master/CODE_OF_CONDUCT.md)\n\n## Communication\n\nFor basic usage questions (e.g., \"_Is XXX currency supported by okama?_\") and for sharing ideas please use [GitHub Discussions](https://github.com/mbk-dev/okama/discussions/3).\nRussian language community is available at [okama.io forums](https://community.okama.io).\n\n## License\n\nMIT\n",

"bugtrack_url": null,

"license": "MIT",

"summary": "Investment portfolio analyzing & optimization tools",

"version": "1.4.4",

"project_urls": {

"Documentation": "https://okama.readthedocs.io/en/master",

"Homepage": "https://okama.io",

"Repository": "https://github.com/mbk-dev/okama"

},

"split_keywords": [

"finance",

" investments",

" efficient frontier",

" python",

" optimization"

],

"urls": [

{

"comment_text": "",

"digests": {

"blake2b_256": "8e893d30f6d8eed509c00c525d7bade22ee386040041ab9239ce1c2476a76fad",

"md5": "530fe8cb65b88a1bd00cfe94cf667efd",

"sha256": "88df5987fb93ec98738eadf7471bae4a3bc4667b3bd04c36ad297d688e6b1156"

},

"downloads": -1,

"filename": "okama-1.4.4-py3-none-any.whl",

"has_sig": false,

"md5_digest": "530fe8cb65b88a1bd00cfe94cf667efd",

"packagetype": "bdist_wheel",

"python_version": "py3",

"requires_python": "<4.0.0,>=3.9",

"size": 86741,

"upload_time": "2024-10-11T09:28:28",

"upload_time_iso_8601": "2024-10-11T09:28:28.770635Z",

"url": "https://files.pythonhosted.org/packages/8e/89/3d30f6d8eed509c00c525d7bade22ee386040041ab9239ce1c2476a76fad/okama-1.4.4-py3-none-any.whl",

"yanked": false,

"yanked_reason": null

},

{

"comment_text": "",

"digests": {

"blake2b_256": "e5b2606863f98852368984b5b3df02477ae94ff3d9332d561ff87554c30559c3",

"md5": "08c610dd651b8ba0082deb6119a65228",

"sha256": "61908eb5b7a4d01f129f073aee6d65c1754a5eb249c472f5e6364d58dca3129f"

},

"downloads": -1,

"filename": "okama-1.4.4.tar.gz",

"has_sig": false,

"md5_digest": "08c610dd651b8ba0082deb6119a65228",

"packagetype": "sdist",

"python_version": "source",

"requires_python": "<4.0.0,>=3.9",

"size": 78279,

"upload_time": "2024-10-11T09:28:30",

"upload_time_iso_8601": "2024-10-11T09:28:30.045552Z",

"url": "https://files.pythonhosted.org/packages/e5/b2/606863f98852368984b5b3df02477ae94ff3d9332d561ff87554c30559c3/okama-1.4.4.tar.gz",

"yanked": false,

"yanked_reason": null

}

],

"upload_time": "2024-10-11 09:28:30",

"github": true,

"gitlab": false,

"bitbucket": false,

"codeberg": false,

"github_user": "mbk-dev",

"github_project": "okama",

"travis_ci": true,

"coveralls": false,

"github_actions": true,

"lcname": "okama"

}