# invest

Python access to structure stock market information

To install: ```pip install invest```

- [invest](#invest)

- [Quick Start](#quick-start)

* [ticker_symbols argument](#ticker-symbols-argument)

* [Notes](#notes)

- [Configuring Ticker objects](#configuring-ticker-objects)

* [Configure a Ticker instance](#configure-a-ticker-instance)

* [Example](#example)

* [Configure a Tickers instance](#configure-a-tickers-instance)

- [Getting (only) specific information about tickers](#getting--only--specific-information-about-tickers)

* [Example: Historical data](#example--historical-data)

* [Example: Specific `'info'` fields](#example--specific---info---fields)

- [BulkHistory](#bulkhistory)

* [Notes](#notes-1)

- [All information](#all-information)

# Quick Start

```python

from invest import Tickers

```

Get a default list of tickers

```python

tickers = Tickers()

```

`tickers` is a dict-like container of tickers. So you can do dict-like things with it, like...

- ask for it's length

```python

len(tickers)

```

4039

- list the keys

```python

list(tickers)[:5]

```

['EGLE', 'KMPH', 'LONG', 'CYBR', 'PTC']

- check for containment of a key

```python

'GOOG' in tickers

```

True

The values of this dict-like object are `Ticker` instances.

```python

ticker = tickers['GOOG']

ticker

```

Ticker('GOOG')

This `ticker` object is also dict-like. Let's see how many keys there are:

```python

len(ticker)

```

40

What are these keys?

```python

list(ticker)

```

['balancesheet',

'dividends',

'get_sustainability',

'get_info',

'get_institutional_holders',

'sustainability',

'quarterly_balance_sheet',

'get_balance_sheet',

'info',

'quarterly_earnings',

'isin',

'earnings',

'history',

'get_balancesheet',

'get_financials',

'balance_sheet',

'get_earnings',

'options',

'splits',

'get_recommendations',

'get_major_holders',

'get_dividends',

'actions',

'recommendations',

'cashflow',

'get_cashflow',

'get_splits',

'major_holders',

'institutional_holders',

'option_chain',

'get_actions',

'quarterly_financials',

'get_calendar',

'quarterly_cashflow',

'calendar',

'financials',

'quarterly_balancesheet',

'get_mutualfund_holders',

'get_isin',

'mutualfund_holders']

Let's look at one of these, `'info'`, which contains a dict with a bunch of information about the ticker...

```python

info = ticker['info']

print(*info, sep=', ')

```

zip, sector, fullTimeEmployees, longBusinessSummary, city, phone, state, country, companyOfficers, website, maxAge, address1, industry, previousClose, regularMarketOpen, twoHundredDayAverage, trailingAnnualDividendYield, payoutRatio, volume24Hr, regularMarketDayHigh, navPrice, averageDailyVolume10Day, totalAssets, regularMarketPreviousClose, fiftyDayAverage, trailingAnnualDividendRate, open, toCurrency, averageVolume10days, expireDate, yield, algorithm, dividendRate, exDividendDate, beta, circulatingSupply, startDate, regularMarketDayLow, priceHint, currency, trailingPE, regularMarketVolume, lastMarket, maxSupply, openInterest, marketCap, volumeAllCurrencies, strikePrice, averageVolume, priceToSalesTrailing12Months, dayLow, ask, ytdReturn, askSize, volume, fiftyTwoWeekHigh, forwardPE, fromCurrency, fiveYearAvgDividendYield, fiftyTwoWeekLow, bid, tradeable, dividendYield, bidSize, dayHigh, exchange, shortName, longName, exchangeTimezoneName, exchangeTimezoneShortName, isEsgPopulated, gmtOffSetMilliseconds, quoteType, symbol, messageBoardId, market, annualHoldingsTurnover, enterpriseToRevenue, beta3Year, profitMargins, enterpriseToEbitda, 52WeekChange, morningStarRiskRating, forwardEps, revenueQuarterlyGrowth, sharesOutstanding, fundInceptionDate, annualReportExpenseRatio, bookValue, sharesShort, sharesPercentSharesOut, fundFamily, lastFiscalYearEnd, heldPercentInstitutions, netIncomeToCommon, trailingEps, lastDividendValue, SandP52WeekChange, priceToBook, heldPercentInsiders, nextFiscalYearEnd, mostRecentQuarter, shortRatio, sharesShortPreviousMonthDate, floatShares, enterpriseValue, threeYearAverageReturn, lastSplitDate, lastSplitFactor, legalType, lastDividendDate, morningStarOverallRating, earningsQuarterlyGrowth, dateShortInterest, pegRatio, lastCapGain, shortPercentOfFloat, sharesShortPriorMonth, category, fiveYearAverageReturn, regularMarketPrice, logo_url

```python

info['shortName']

```

'Alphabet Inc.'

```python

info['sector']

```

'Communication Services'

```python

df = ticker['history']

df

```

<div>

<table border="1" class="dataframe">

<thead>

<tr style="text-align: right;">

<th></th>

<th>Open</th>

<th>High</th>

<th>Low</th>

<th>Close</th>

<th>Volume</th>

<th>Dividends</th>

<th>Stock Splits</th>

</tr>

<tr>

<th>Date</th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

</tr>

</thead>

<tbody>

<tr>

<th>2020-10-28</th>

<td>1559.739990</td>

<td>1561.349976</td>

<td>1514.619995</td>

<td>1516.619995</td>

<td>1834000</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-10-29</th>

<td>1522.359985</td>

<td>1593.709961</td>

<td>1522.239990</td>

<td>1567.239990</td>

<td>2003100</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-10-30</th>

<td>1672.109985</td>

<td>1687.000000</td>

<td>1604.459961</td>

<td>1621.010010</td>

<td>4329100</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-02</th>

<td>1628.160034</td>

<td>1660.770020</td>

<td>1616.030029</td>

<td>1626.030029</td>

<td>2535400</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-03</th>

<td>1631.780029</td>

<td>1661.699951</td>

<td>1616.619995</td>

<td>1650.209961</td>

<td>1661700</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-04</th>

<td>1710.280029</td>

<td>1771.364990</td>

<td>1706.030029</td>

<td>1749.130005</td>

<td>3570900</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-05</th>

<td>1781.000000</td>

<td>1793.640015</td>

<td>1750.510010</td>

<td>1763.369995</td>

<td>2065800</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-06</th>

<td>1753.949951</td>

<td>1772.430054</td>

<td>1740.349976</td>

<td>1761.750000</td>

<td>1660900</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-09</th>

<td>1790.900024</td>

<td>1818.060059</td>

<td>1760.020020</td>

<td>1763.000000</td>

<td>2268300</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-10</th>

<td>1731.089966</td>

<td>1763.000000</td>

<td>1717.300049</td>

<td>1740.390015</td>

<td>2636100</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-11</th>

<td>1750.000000</td>

<td>1764.219971</td>

<td>1747.364990</td>

<td>1752.709961</td>

<td>1264000</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-12</th>

<td>1747.630005</td>

<td>1768.270020</td>

<td>1745.599976</td>

<td>1749.839966</td>

<td>1247500</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-13</th>

<td>1757.630005</td>

<td>1781.040039</td>

<td>1744.550049</td>

<td>1777.020020</td>

<td>1499900</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-16</th>

<td>1771.699951</td>

<td>1799.069946</td>

<td>1767.689941</td>

<td>1781.380005</td>

<td>1246800</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-17</th>

<td>1776.939941</td>

<td>1785.000000</td>

<td>1767.000000</td>

<td>1770.150024</td>

<td>1147100</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-18</th>

<td>1765.229980</td>

<td>1773.469971</td>

<td>1746.140015</td>

<td>1746.780029</td>

<td>1173500</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-19</th>

<td>1738.380005</td>

<td>1769.589966</td>

<td>1737.005005</td>

<td>1763.920044</td>

<td>1249900</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-20</th>

<td>1765.209961</td>

<td>1774.000000</td>

<td>1741.859985</td>

<td>1742.189941</td>

<td>2313500</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-23</th>

<td>1749.599976</td>

<td>1753.900024</td>

<td>1717.719971</td>

<td>1734.859985</td>

<td>2161600</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-24</th>

<td>1730.500000</td>

<td>1771.599976</td>

<td>1727.689941</td>

<td>1768.880005</td>

<td>1578000</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-25</th>

<td>1772.890015</td>

<td>1778.540039</td>

<td>1756.540039</td>

<td>1771.430054</td>

<td>1045800</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27</th>

<td>1773.089966</td>

<td>1804.000000</td>

<td>1772.439941</td>

<td>1793.189941</td>

<td>884900</td>

<td>0</td>

<td>0</td>

</tr>

</tbody>

</table>

</div>

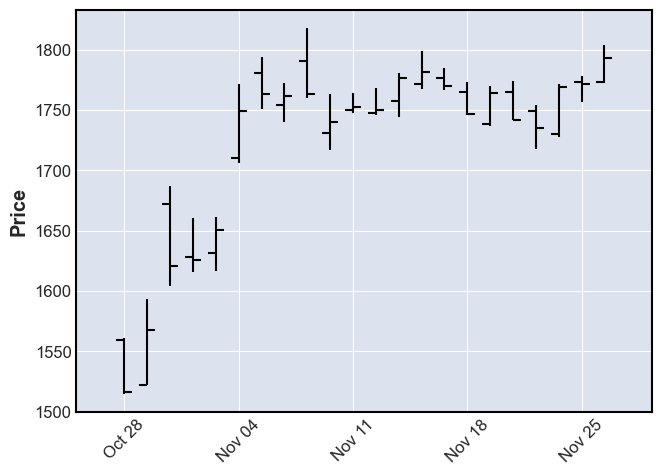

```python

from mplfinance import plot as candlestick_plot # pip install mplfinance if you don't have it already

candlestick_plot(df)

```

But these are daily metrics and only for the recent (yes, I'm doing this on a Thanksgiving week-end!) past.

How do I get something different? Like a longer history, and/or at a finer time-granularity?

See the next _Configuring Ticker objects_ section on how to do that.

## ticker_symbols argument

The first argument of `Tickers` is the `ticker_symbols` argument.

One can specify a collection (list, set, tuple, etc.) of ticker symbol strings, or a path to a file containing a pickle of such a collection.

The default is the string `'local_list'` which has the effect of using a default list (currently of about 4000 tickers), but it's contents can change in the future.

Note that this `ticker_symbols` will have an effect on such affairs as `list(tickers)`, `len(tickers)`, or `s in tickers`, when it's relevant to use these.

But any `Tickers` object will allow access to any ticker symbol, regardless if it's in the `ticker_symbols` collection or not.

```python

tickers = Tickers(ticker_symbols=('GOOG', 'AAPL', 'AMZN'))

assert list(tickers) == ['GOOG', 'AAPL', 'AMZN']

assert len(tickers) == 3

assert 'AAPL' in tickers

assert 'NFLX' not in tickers

# and yet we have access to NFLX info

assert tickers['NFLX']['info']['shortName'] == 'Netflix, Inc.'

```

```python

```

## Notes

- Both `Tickers` and `Ticker` instances have tab-triggered auto-suggestion enabled when you get an item. Example: `tickers['AA<now press the TAB button...>`.

- The specification of

```python

```

# Configuring Ticker objects

## Configure a Ticker instance

You can instantiate a `Ticker` instance directly, from **any valid ticker symbol**. The `Tickers` class is just a way to make a collection of tickers to work with.

```python

from invest import Tickers, Ticker

ticker = Ticker('GOOG')

ticker

```

Ticker('GOOG')

But you'll notice that `Ticker` (and `Tickers`) have more than one argument.

```python

from inspect import signature

print(signature(Tickers))

print(signature(Ticker))

```

(ticker_symbols='local_list', **kwargs_for_method_keys)

(ticker_symbol: str, **kwargs_for_method_keys)

What's this `kwargs_for_method_keys`?

Well, at the time of writing this, `Ticker` object is just a convenient dict-like interface to the attributes of the `Ticker` of the `yfinance` package which is itself a convenient python interface to the yahoo finance API.

When you do `list(ticker)`, you're just getting a list of attributes of `yfinance.Ticker`: Both properties and methods that don't require any arguments. Though these methods don't require any arguments -- meaning all their arguments have defaults -- you can still specify if you want to use different defaults.

That's where `kwargs_for_method_keys` comes in. It specifies what `arg=val` pairs that should be used for particular methods of `yfinance.Ticker`.

If you want to know more about what you can do with the `Ticker` object, you might want to check out `yfinance`'s and yahoo finance API's documentation.

For the basics though, `invest` provides the `help_me_with` function (as a standalone function or as a method in `Tickers` and `Ticker`) for quick access to essentials.

```python

Ticker.help_me_with('history')

```

history

wraps <function TickerBase.history at 0x11a064940>, whose signature is:

(self, period='1mo', interval='1d', start=None, end=None, prepost=False, actions=True, auto_adjust=True, back_adjust=False, proxy=None, rounding=False, tz=None, **kwargs)

:Parameters:

period : str

Valid periods: 1d,5d,1mo,3mo,6mo,1y,2y,5y,10y,ytd,max

Either Use period parameter or use start and end

interval : str

Valid intervals: 1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo

Intraday data cannot extend last 60 days

start: str

Download start date string (YYYY-MM-DD) or _datetime.

Default is 1900-01-01

end: str

Download end date string (YYYY-MM-DD) or _datetime.

Default is now

prepost : bool

Include Pre and Post market data in results?

Default is False

auto_adjust: bool

Adjust all OHLC automatically? Default is True

back_adjust: bool

Back-adjusted data to mimic true historical prices

proxy: str

Optional. Proxy server URL scheme. Default is None

rounding: bool

Round values to 2 decimal places?

Optional. Default is False = precision suggested by Yahoo!

tz: str

Optional timezone locale for dates.

(default data is returned as non-localized dates)

**kwargs: dict

debug: bool

Optional. If passed as False, will suppress

error message printing to console.

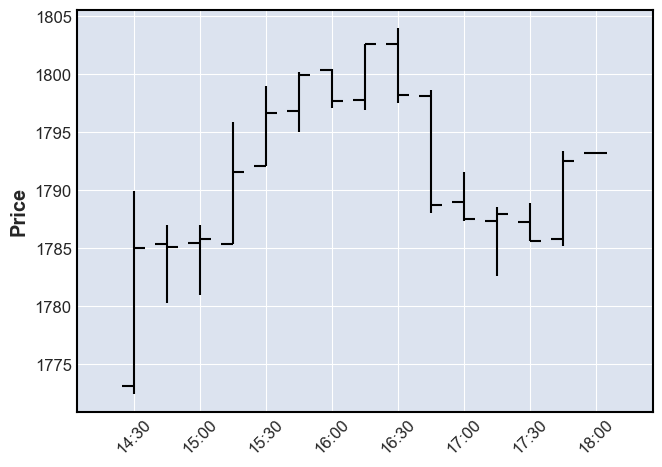

## Example

Here's you can get `history` to give you something different.

Say, get data for the last day, with a granularity of 15 minutes.

```python

ticker = Ticker('GOOG', history=dict(period='1d', interval='15m'))

ticker

```

Ticker('GOOG', history={'period': '1d', 'interval': '15m'})

Your ticker is almost identical to the previous one we made, or the one we got from `Tickers`, except for the fact that asking for `ticker['history']` is going to give you something different.

```python

df = ticker['history']

df

```

<div>

<table border="1" class="dataframe">

<thead>

<tr style="text-align: right;">

<th></th>

<th>Open</th>

<th>High</th>

<th>Low</th>

<th>Close</th>

<th>Volume</th>

<th>Dividends</th>

<th>Stock Splits</th>

</tr>

<tr>

<th>Datetime</th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

<th></th>

</tr>

</thead>

<tbody>

<tr>

<th>2020-11-27 09:30:00-05:00</th>

<td>1773.089966</td>

<td>1789.890015</td>

<td>1772.439941</td>

<td>1785.000000</td>

<td>119289</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 09:45:00-05:00</th>

<td>1785.380005</td>

<td>1786.979980</td>

<td>1780.229980</td>

<td>1785.089966</td>

<td>50660</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 10:00:00-05:00</th>

<td>1785.489990</td>

<td>1786.989990</td>

<td>1780.959961</td>

<td>1785.800049</td>

<td>50797</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 10:15:00-05:00</th>

<td>1785.319946</td>

<td>1795.925049</td>

<td>1785.319946</td>

<td>1791.589966</td>

<td>72146</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 10:30:00-05:00</th>

<td>1792.060059</td>

<td>1798.999878</td>

<td>1792.060059</td>

<td>1796.699951</td>

<td>48097</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 10:45:00-05:00</th>

<td>1796.800049</td>

<td>1800.199951</td>

<td>1795.060059</td>

<td>1799.959961</td>

<td>56292</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 11:00:00-05:00</th>

<td>1800.359985</td>

<td>1800.449951</td>

<td>1797.130005</td>

<td>1797.660034</td>

<td>41882</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 11:15:00-05:00</th>

<td>1797.819946</td>

<td>1802.599976</td>

<td>1796.949951</td>

<td>1802.579956</td>

<td>60333</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 11:30:00-05:00</th>

<td>1802.579956</td>

<td>1804.000000</td>

<td>1797.550049</td>

<td>1798.185059</td>

<td>45667</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 11:45:00-05:00</th>

<td>1798.099976</td>

<td>1798.603027</td>

<td>1788.000000</td>

<td>1788.739990</td>

<td>47900</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 12:00:00-05:00</th>

<td>1789.000000</td>

<td>1791.599976</td>

<td>1787.329956</td>

<td>1787.500000</td>

<td>36459</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 12:15:00-05:00</th>

<td>1787.347534</td>

<td>1788.530029</td>

<td>1782.574951</td>

<td>1787.952759</td>

<td>46400</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 12:30:00-05:00</th>

<td>1787.260010</td>

<td>1788.920044</td>

<td>1785.640015</td>

<td>1785.640015</td>

<td>45660</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 12:45:00-05:00</th>

<td>1785.829956</td>

<td>1793.420044</td>

<td>1785.219971</td>

<td>1792.520020</td>

<td>97273</td>

<td>0</td>

<td>0</td>

</tr>

<tr>

<th>2020-11-27 13:00:00-05:00</th>

<td>1793.189941</td>

<td>1793.189941</td>

<td>1793.189941</td>

<td>1793.189941</td>

<td>46982</td>

<td>0</td>

<td>0</td>

</tr>

</tbody>

</table>

</div>

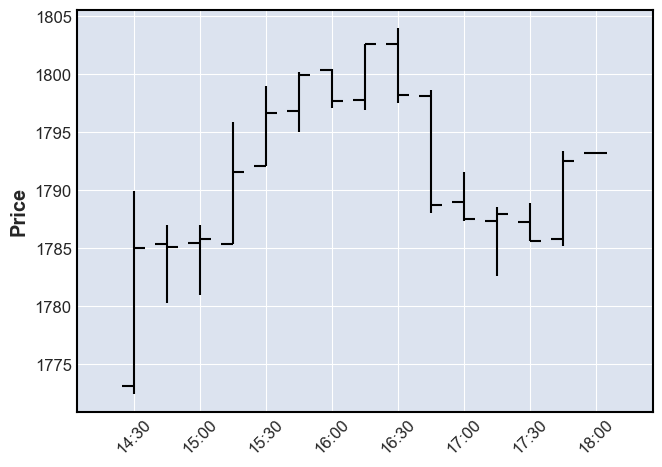

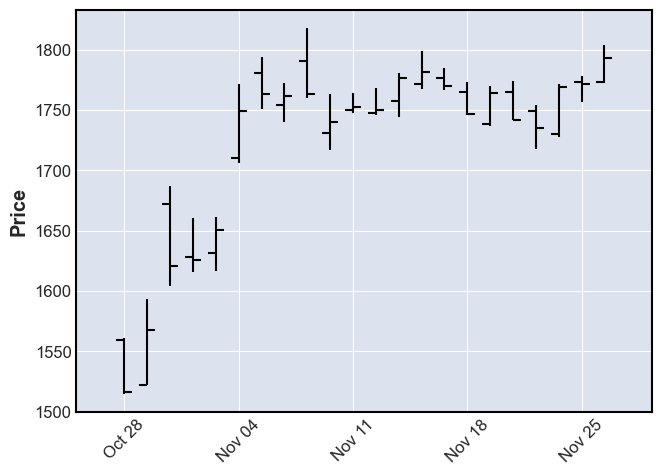

```python

from mplfinance import plot as candlestick_plot # pip install mplfinance if you don't have it already

candlestick_plt(df)

```

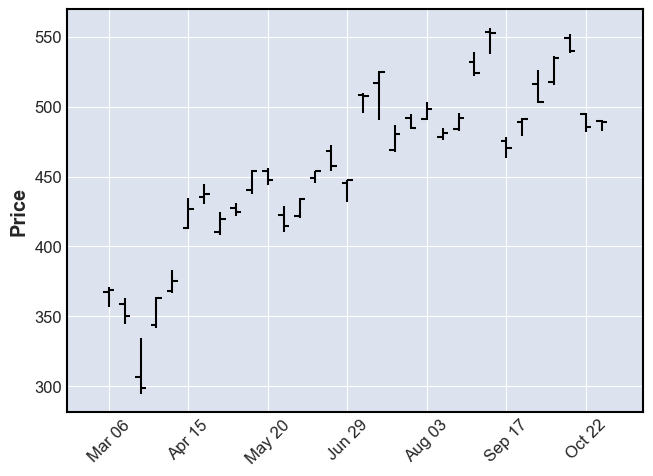

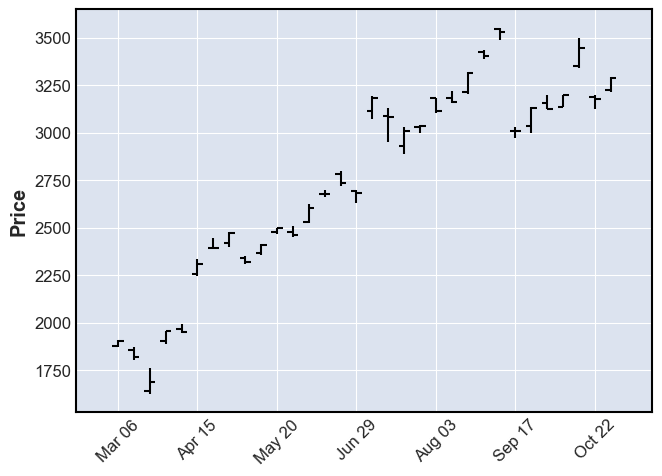

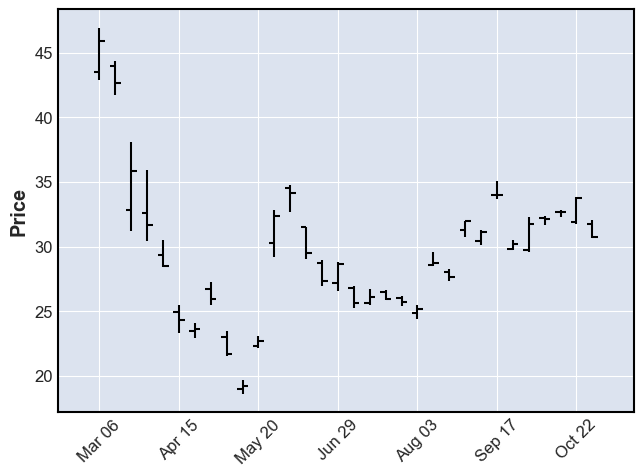

## Configure a Tickers instance

Let's say we wanted all ticker instances that `Tickers` gives us to have their `history` be over a specific interval of time in the past (say, during the 2020 pandemic), at 5 day intervals...

```python

tickers = Tickers(ticker_symbols={'NFLX', 'AMZN', 'DAL'}, # demoing the fact that we can specify an explicit collection of ticker symbols

history=dict(start='2020-03-01', end='2020-10-31', interval='5d'))

list(tickers)

```

['DAL', 'AMZN', 'NFLX']

See that indeed, all tickers given by `tickers` are configured according to our wishes.

```python

tickers['NFLX']

```

Ticker('NFLX', history={'start': '2020-03-01', 'end': '2020-10-31', 'interval': '5d'})

```python

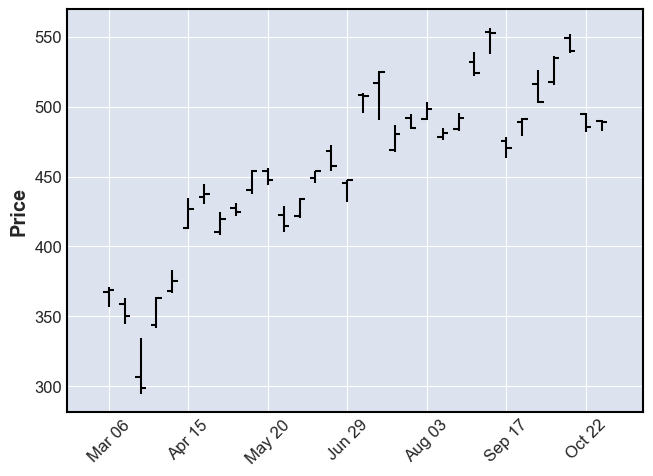

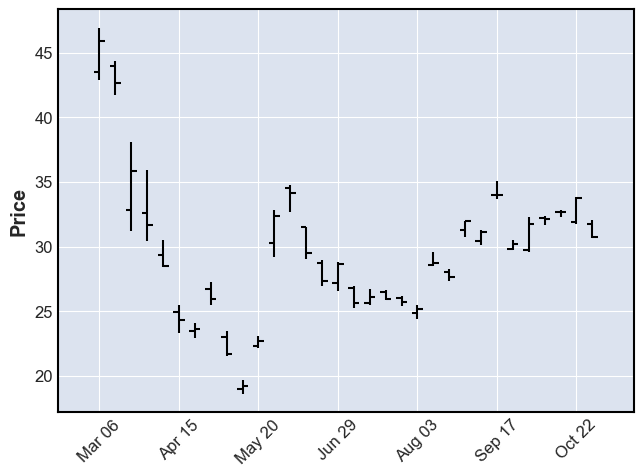

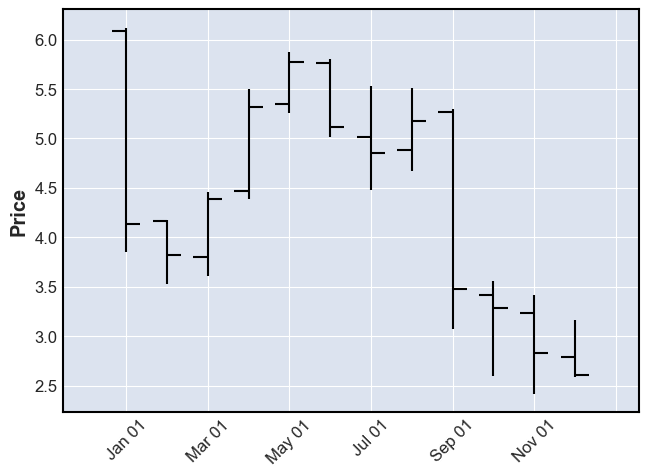

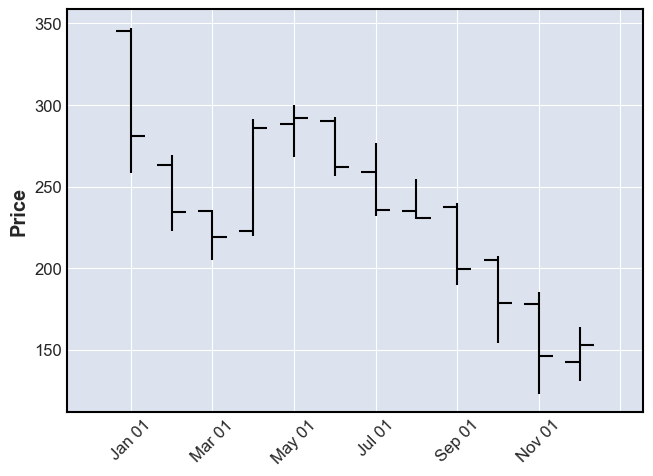

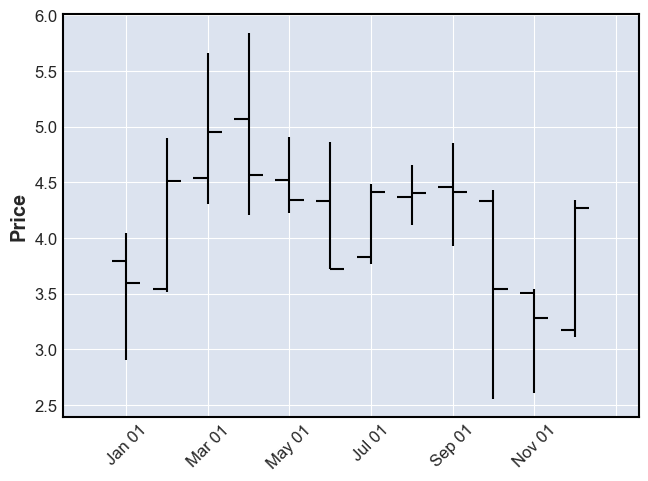

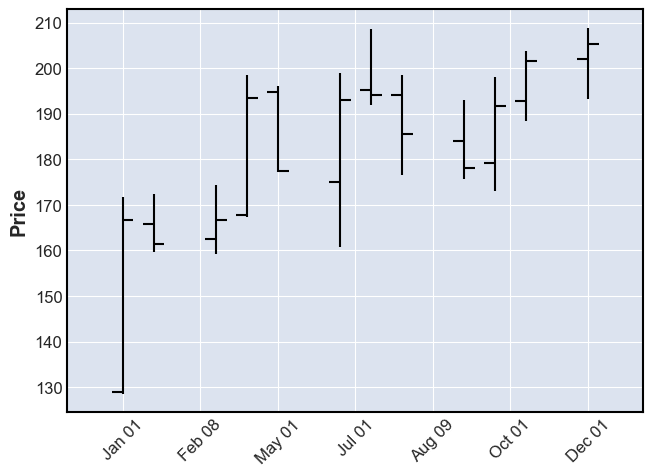

from mplfinance import plot as candlestick_plot # pip install mplfinance if you don't have it already

candlestick_plot(tickers['NFLX']['history'])

```

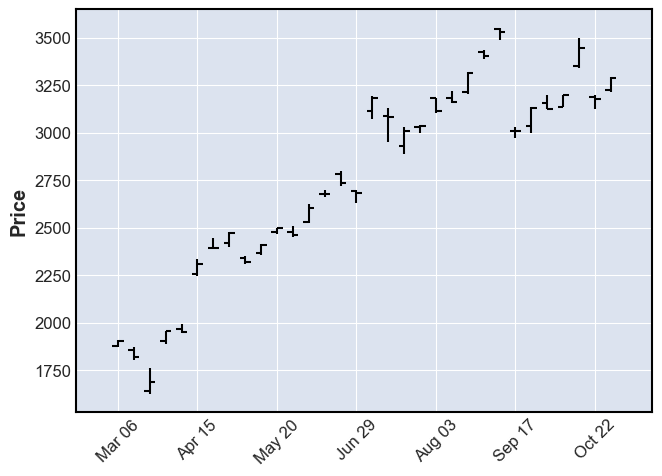

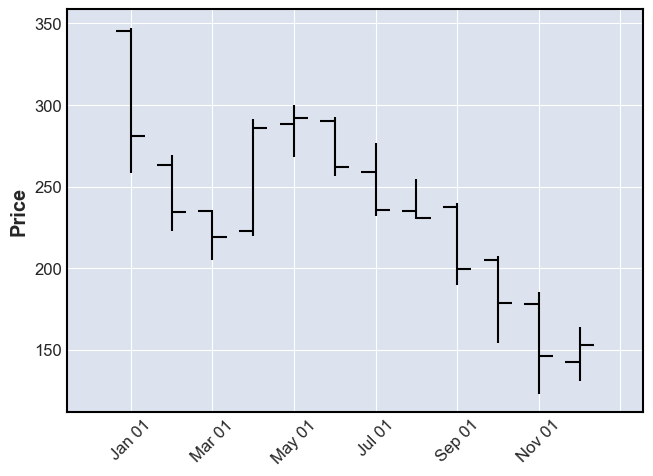

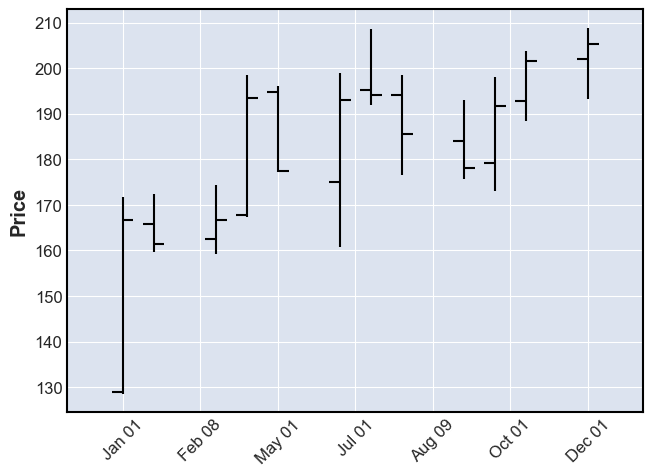

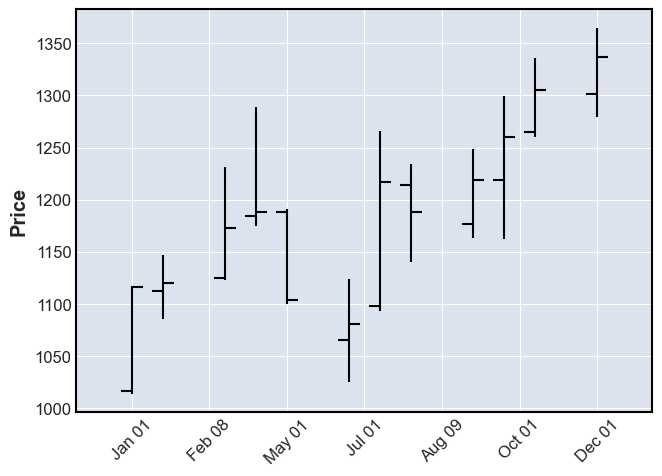

```python

candlestick_plot(tickers['AMZN']['history'])

```

So Netflix and Amazon did well.

Delta, less so:

```python

candlestick_plot(tickers['DAL']['history'])

```

# Getting (only) specific information about tickers

`Tickers` and `Ticker` are convenient if you want to analyze several aspects of a ticker since you can poke around the various keys (e.g. `info`, `history`, etc.).

But if a particular analysis only needs one of these, it's more convenient to use `TickersWithSpecificInfo`,

which gives you the same interface as `Tickers` (in fact, it's a subclass if `Tickers`),

but fixes the key.

## Example: Historical data

For example, if you're only interested in the historical data (a.k.a. the `'history'` key), you might do this:

```python

from invest import TickersWithSpecificInfo

tickers = TickersWithSpecificInfo(specific_key='history', start='2008-01-01', end='2009-01-01', interval='1mo') # 2008 historical data, month granularity

tickers

```

TickersWithSpecificInfo(ticker_symbols=<local_list>, specific_key=history, start=2008-01-01, end=2009-01-01, interval=1mo)

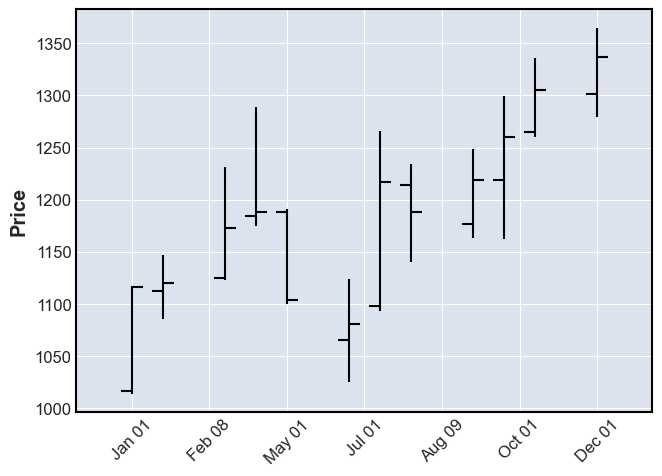

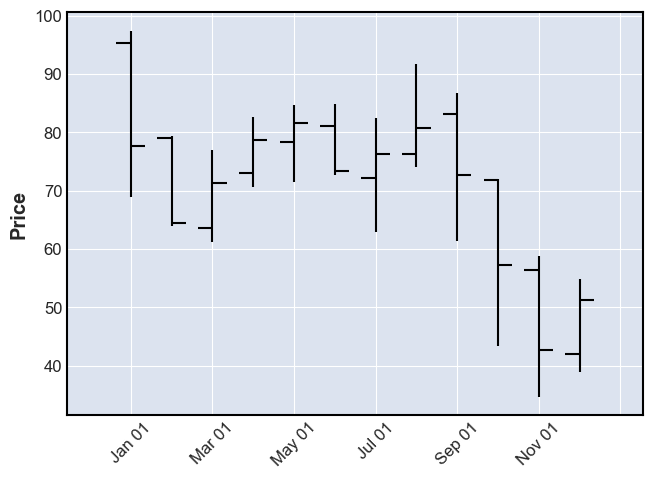

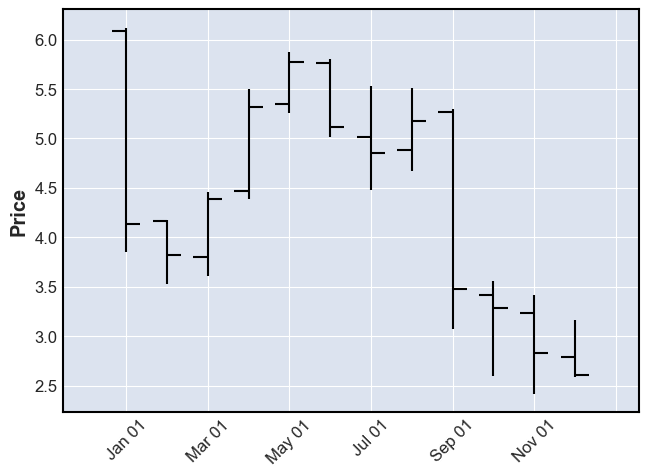

```python

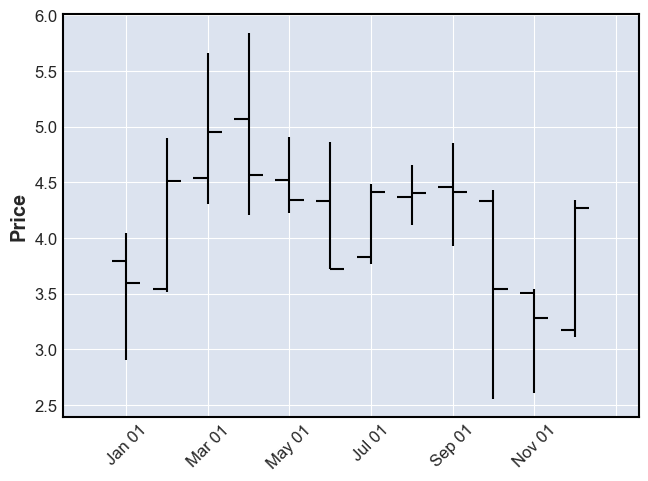

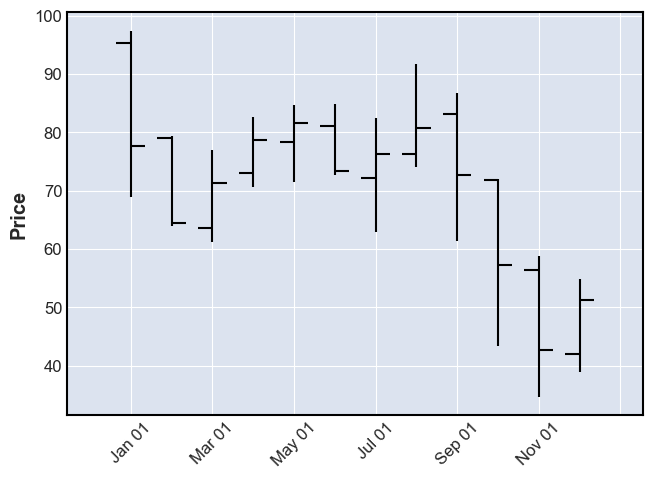

candlestick_plot(tickers['GOOG'])

```

```python

candlestick_plot(tickers['NFLX'])

```

```python

candlestick_plot(tickers['AMZN'])

```

```python

candlestick_plot(tickers['AAPL'])

```

## Example: Specific `'info'` fields

```python

from invest import TickersWithSpecificInfo

the_info_that_i_want = ['shortName', 'sector', 'earningsQuarterlyGrowth', 'sharesShortPriorMonth']

tickers = TickersWithSpecificInfo(specific_key='info', val_trans=lambda d: {k: d[k] for k in the_info_that_i_want})

tickers

```

TickersWithSpecificInfo(ticker_symbols=<local_list>, specific_key=info, val_trans=<function <lambda> at 0x11c2374c0>)

Now, you won't get the overwhelming amount of information you usually get with `info`:

```python

tickers['AAPL']

```

{'shortName': 'Apple Inc.',

'sector': 'Technology',

'earningsQuarterlyGrowth': -0.074,

'sharesShortPriorMonth': 83252522}

```python

faang_tickers = ('FB', 'AMZN', 'AAPL', 'NFLX', 'GOOG')

the_info_that_i_want = ['shortName', 'sector', 'earningsQuarterlyGrowth', 'sharesShortPriorMonth']

tickers = TickersWithSpecificInfo(faang_tickers, specific_key='info', val_trans=lambda d: {k: d[k] for k in the_info_that_i_want})

tickers

```

TickersWithSpecificInfo(ticker_symbols=('FB', 'AMZN', 'AAPL', 'NFLX', 'GOOG'), specific_key=info, val_trans=<function <lambda> at 0x11c237a60>)

```python

info_df = pd.DataFrame(list(tickers.values()))

info_df

```

<div>

<table border="1" class="dataframe">

<thead>

<tr style="text-align: right;">

<th></th>

<th>shortName</th>

<th>sector</th>

<th>earningsQuarterlyGrowth</th>

<th>sharesShortPriorMonth</th>

</tr>

</thead>

<tbody>

<tr>

<th>0</th>

<td>Facebook, Inc.</td>

<td>Communication Services</td>

<td>0.288</td>

<td>21187652</td>

</tr>

<tr>

<th>1</th>

<td>Amazon.com, Inc.</td>

<td>Consumer Cyclical</td>

<td>1.967</td>

<td>2509939</td>

</tr>

<tr>

<th>2</th>

<td>Apple Inc.</td>

<td>Technology</td>

<td>-0.074</td>

<td>83252522</td>

</tr>

<tr>

<th>3</th>

<td>Netflix, Inc.</td>

<td>Communication Services</td>

<td>0.187</td>

<td>9416477</td>

</tr>

<tr>

<th>4</th>

<td>Alphabet Inc.</td>

<td>Communication Services</td>

<td>0.591</td>

<td>2381334</td>

</tr>

</tbody>

</table>

</div>

# BulkHistory

```python

from invest import BulkHistory

tickers = BulkHistory(start='2019-01-01', end='2020-01-01', interval='1mo') # 2019 historical data, month granularity

tickers

```

BulkHistory(ticker_symbols=['FB', 'AMZN', 'AAPL', 'NFLX', 'GOOG'], history={'start': '2019-01-01', 'end': '2020-01-01', 'interval': '1mo'})

```python

candlestick_plot(tickers['FB'])

```

[*********************100%***********************] 5 of 5 completed

Notice that the data doesn't download again when we ask for `GOOG` data. That's because the first download bulk downloaded the data for our whole list of ticker symbols.

```python

candlestick_plot(tickers['GOOG'])

```

## Notes

- - Though `Tickers` allows you to deal with a collection of tickers, it does so (for time being) by calling

yahoo's API for each individual ticker.

The API does, on the other hand, contain some bulk tickers routes which we intend to integrate.

For historical data (`history`), we have `BulkHistory` that uses the bulk API (through `yfinance.Tickers`),

but for other information (such at the `info` key), we don't (yet).

# All information

Some utils to get all data on a single ticker.

```python

from invest import Ticker

from invest import all_info, all_info_printable_string

ticker = Ticker('GOOG')

d = dict(all_info(ticker)) # all_info is a generator of (key, val) pairs (only for non-empty values), so can use dict to accumulate

list(d) # list of keys (data names) we have data (values) for, for the given ticker

```

['financials',

'quarterly_balance_sheet',

'institutional_holders',

'major_holders',

'history',

'quarterly_earnings',

'info',

'mutualfund_holders',

'calendar',

'option_chain',

'quarterly_cashflow',

'recommendations',

'cashflow',

'options',

'balance_sheet',

'quarterly_financials',

'isin',

'earnings']

```python

print(f"The following data is for ticker: {ticker.ticker_symbol}\n\n")

print(all_info_printable_string(ticker))

```

The following data is for ticker: GOOG

----------financials-------------

2019-12-31 2018-12-31 2017-12-31 \

Research Development 2.6018e+10 2.1419e+10 1.6625e+10

Effect Of Accounting Charges None None None

Income Before Tax 3.9625e+10 3.4913e+10 2.7193e+10

Minority Interest None None None

Net Income 3.4343e+10 3.0736e+10 1.2662e+10

Selling General Administrative 2.7461e+10 2.3256e+10 1.9733e+10

Gross Profit 8.9961e+10 7.727e+10 6.5272e+10

Ebit 3.6482e+10 3.2595e+10 2.8914e+10

Operating Income 3.6482e+10 3.2595e+10 2.8914e+10

Other Operating Expenses None None None

Interest Expense -1e+08 -1.14e+08 -1.09e+08

Extraordinary Items None None None

Non Recurring None None None

Other Items None None None

Income Tax Expense 5.282e+09 4.177e+09 1.4531e+10

Total Revenue 1.61857e+11 1.36819e+11 1.10855e+11

Total Operating Expenses 1.25375e+11 1.04224e+11 8.1941e+10

Cost Of Revenue 7.1896e+10 5.9549e+10 4.5583e+10

Total Other Income Expense Net 3.143e+09 2.318e+09 -1.721e+09

Discontinued Operations None None None

Net Income From Continuing Ops 3.4343e+10 3.0736e+10 1.2662e+10

Net Income Applicable To Common Shares 3.4343e+10 3.0736e+10 1.2662e+10

2016-12-31

Research Development 1.3948e+10

Effect Of Accounting Charges None

Income Before Tax 2.415e+10

Minority Interest None

Net Income 1.9478e+10

Selling General Administrative 1.747e+10

Gross Profit 5.5134e+10

Ebit 2.3716e+10

Operating Income 2.3716e+10

Other Operating Expenses None

Interest Expense -1.24e+08

Extraordinary Items None

Non Recurring None

Other Items None

Income Tax Expense 4.672e+09

Total Revenue 9.0272e+10

Total Operating Expenses 6.6556e+10

Cost Of Revenue 3.5138e+10

Total Other Income Expense Net 4.34e+08

Discontinued Operations None

Net Income From Continuing Ops 1.9478e+10

Net Income Applicable To Common Shares 1.9478e+10

----------quarterly_balance_sheet-------------

2020-09-30 2020-06-30 2020-03-31 \

Intangible Assets 1.520000e+09 1.697000e+09 1.840000e+09

Total Liab 8.632300e+10 7.117000e+10 6.974400e+10

Total Stockholder Equity 2.129200e+11 2.073220e+11 2.036590e+11

Other Current Liab 2.406800e+10 2.193400e+10 2.187200e+10

Total Assets 2.992430e+11 2.784920e+11 2.734030e+11

Common Stock 5.730700e+10 5.593700e+10 5.368800e+10

Other Current Assets 5.425000e+09 5.579000e+09 5.165000e+09

Retained Earnings 1.555670e+11 1.516810e+11 1.510680e+11

Other Liab 1.323700e+10 1.278500e+10 1.406300e+10

Good Will 2.087000e+10 2.082400e+10 2.073400e+10

Treasury Stock 4.600000e+07 -2.960000e+08 -1.097000e+09

Other Assets 3.799000e+09 3.626000e+09 3.478000e+09

Cash 2.012900e+10 1.774200e+10 1.964400e+10

Total Current Liabilities 4.820000e+10 4.365800e+10 4.018900e+10

Deferred Long Term Asset Charges 9.720000e+08 8.950000e+08 7.300000e+08

Short Long Term Debt 9.990000e+08 9.990000e+08 NaN

Other Stockholder Equity 4.600000e+07 -2.960000e+08 -1.097000e+09

Property Plant Equipment 9.358200e+10 9.031500e+10 8.796600e+10

Total Current Assets 1.643690e+11 1.490690e+11 1.470180e+11

Long Term Investments 1.510300e+10 1.296100e+10 1.236700e+10

Net Tangible Assets 1.905300e+11 1.848010e+11 1.810850e+11

Short Term Investments 1.124670e+11 1.033380e+11 9.758500e+10

Net Receivables 2.551300e+10 2.159500e+10 2.373500e+10

Long Term Debt 1.282800e+10 2.963000e+09 3.960000e+09

Inventory 8.350000e+08 8.150000e+08 8.890000e+08

Accounts Payable 4.391000e+09 4.064000e+09 4.099000e+09

2019-12-31

Intangible Assets 1.979000e+09

Total Liab 7.446700e+10

Total Stockholder Equity 2.014420e+11

Other Current Liab 2.215900e+10

Total Assets 2.759090e+11

Common Stock 5.055200e+10

Other Current Assets 4.412000e+09

Retained Earnings 1.521220e+11

Other Liab 1.447800e+10

Good Will 2.062400e+10

Treasury Stock -1.232000e+09

Other Assets 3.063000e+09

Cash 1.849800e+10

Total Current Liabilities 4.522100e+10

Deferred Long Term Asset Charges 7.210000e+08

Short Long Term Debt NaN

Other Stockholder Equity -1.232000e+09

Property Plant Equipment 8.458700e+10

Total Current Assets 1.525780e+11

Long Term Investments 1.307800e+10

Net Tangible Assets 1.788390e+11

Short Term Investments 1.011770e+11

Net Receivables 2.749200e+10

Long Term Debt 3.958000e+09

Inventory 9.990000e+08

Accounts Payable 5.561000e+09

----------institutional_holders-------------

Holder Shares Date Reported % Out \

0 Vanguard Group, Inc. (The) 22204175 2020-09-29 0.0673

1 Blackrock Inc. 20032538 2020-09-29 0.0607

2 Price (T.Rowe) Associates Inc 13396372 2020-09-29 0.0406

3 State Street Corporation 11589194 2020-09-29 0.0351

4 FMR, LLC 7687258 2020-09-29 0.0233

5 Geode Capital Management, LLC 4431554 2020-09-29 0.0134

6 Capital International Investors 4071062 2020-09-29 0.0123

7 Northern Trust Corporation 3981710 2020-09-29 0.0121

8 AllianceBernstein, L.P. 3889575 2020-09-29 0.0118

9 Bank Of New York Mellon Corporation 3519043 2020-09-29 0.0107

Value

0 32631255580

1 29439817844

2 19687308291

3 17031479502

4 11297194356

5 6512611758

6 5982832715

7 5851521016

8 5716119420

9 5171585592

----------major_holders-------------

0 1

0 5.84% % of Shares Held by All Insider

1 68.32% % of Shares Held by Institutions

2 72.56% % of Float Held by Institutions

3 3396 Number of Institutions Holding Shares

----------history-------------

Open High Low Close Volume \

Date

2020-10-30 1672.109985 1687.000000 1604.459961 1621.010010 4329100

2020-11-02 1628.160034 1660.770020 1616.030029 1626.030029 2535400

2020-11-03 1631.780029 1661.699951 1616.619995 1650.209961 1661700

2020-11-04 1710.280029 1771.364990 1706.030029 1749.130005 3570900

2020-11-05 1781.000000 1793.640015 1750.510010 1763.369995 2065800

2020-11-06 1753.949951 1772.430054 1740.349976 1761.750000 1660900

2020-11-09 1790.900024 1818.060059 1760.020020 1763.000000 2268300

2020-11-10 1731.089966 1763.000000 1717.300049 1740.390015 2636100

2020-11-11 1750.000000 1764.219971 1747.364990 1752.709961 1264000

2020-11-12 1747.630005 1768.270020 1745.599976 1749.839966 1247500

2020-11-13 1757.630005 1781.040039 1744.550049 1777.020020 1499900

2020-11-16 1771.699951 1799.069946 1767.689941 1781.380005 1246800

2020-11-17 1776.939941 1785.000000 1767.000000 1770.150024 1147100

2020-11-18 1765.229980 1773.469971 1746.140015 1746.780029 1173500

2020-11-19 1738.380005 1769.589966 1737.005005 1763.920044 1249900

2020-11-20 1765.209961 1774.000000 1741.859985 1742.189941 2313500

2020-11-23 1749.599976 1753.900024 1717.719971 1734.859985 2161600

2020-11-24 1730.500000 1771.599976 1727.689941 1768.880005 1578000

2020-11-25 1772.890015 1778.540039 1756.540039 1771.430054 1045800

2020-11-27 1773.089966 1804.000000 1772.439941 1793.189941 884900

2020-11-30 1781.180054 1788.064941 1755.010010 1765.175049 871053

Dividends Stock Splits

Date

2020-10-30 0 0

2020-11-02 0 0

2020-11-03 0 0

2020-11-04 0 0

2020-11-05 0 0

2020-11-06 0 0

2020-11-09 0 0

2020-11-10 0 0

2020-11-11 0 0

2020-11-12 0 0

2020-11-13 0 0

2020-11-16 0 0

2020-11-17 0 0

2020-11-18 0 0

2020-11-19 0 0

2020-11-20 0 0

2020-11-23 0 0

2020-11-24 0 0

2020-11-25 0 0

2020-11-27 0 0

2020-11-30 0 0

----------quarterly_earnings-------------

Revenue Earnings

Quarter

4Q2019 46075000000 10671000000

1Q2020 41159000000 6836000000

2Q2020 38297000000 6959000000

3Q2020 46173000000 11247000000

----------info-------------

{'zip': '94043', 'sector': 'Communication Services', 'fullTimeEmployees': 132121, 'longBusinessSummary': 'Alphabet Inc. provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It offers performance and brand advertising services. The company operates through Google and Other Bets segments. The Google segment offers products, such as Ads, Android, Chrome, Google Cloud, Google Maps, Google Play, Hardware, Search, and YouTube, as well as technical infrastructure. It also offers digital content, cloud services, hardware devices, and other miscellaneous products and services. The Other Bets segment includes businesses, including Access, Calico, CapitalG, GV, Verily, Waymo, and X, as well as Internet and television services. The company has an agreement with Sabre Corporation to develop an artificial intelligence-driven technology platform for travel. Alphabet Inc. was founded in 1998 and is headquartered in Mountain View, California.', 'city': 'Mountain View', 'phone': '650-253-0000', 'state': 'CA', 'country': 'United States', 'companyOfficers': [], 'website': 'http://www.abc.xyz', 'maxAge': 1, 'address1': '1600 Amphitheatre Parkway', 'industry': 'Internet Content & Information', 'previousClose': 1793.19, 'regularMarketOpen': 1781.18, 'twoHundredDayAverage': 1534.4911, 'trailingAnnualDividendYield': None, 'payoutRatio': 0, 'volume24Hr': None, 'regularMarketDayHigh': 1788.065, 'navPrice': None, 'averageDailyVolume10Day': 1596760, 'totalAssets': None, 'regularMarketPreviousClose': 1793.19, 'fiftyDayAverage': 1673.1482, 'trailingAnnualDividendRate': None, 'open': 1781.18, 'toCurrency': None, 'averageVolume10days': 1596760, 'expireDate': None, 'yield': None, 'algorithm': None, 'dividendRate': None, 'exDividendDate': None, 'beta': 1.023111, 'circulatingSupply': None, 'startDate': None, 'regularMarketDayLow': 1755.01, 'priceHint': 2, 'currency': 'USD', 'trailingPE': 34.105736, 'regularMarketVolume': 870307, 'lastMarket': None, 'maxSupply': None, 'openInterest': None, 'marketCap': 1191815020544, 'volumeAllCurrencies': None, 'strikePrice': None, 'averageVolume': 1823157, 'priceToSalesTrailing12Months': 6.9411025, 'dayLow': 1755.01, 'ask': 1763.88, 'ytdReturn': None, 'askSize': 1100, 'volume': 870307, 'fiftyTwoWeekHigh': 1818.06, 'forwardPE': 28.793476, 'fromCurrency': None, 'fiveYearAvgDividendYield': None, 'fiftyTwoWeekLow': 1013.536, 'bid': 1762.58, 'tradeable': False, 'dividendYield': None, 'bidSize': 900, 'dayHigh': 1788.065, 'exchange': 'NMS', 'shortName': 'Alphabet Inc.', 'longName': 'Alphabet Inc.', 'exchangeTimezoneName': 'America/New_York', 'exchangeTimezoneShortName': 'EST', 'isEsgPopulated': False, 'gmtOffSetMilliseconds': '-18000000', 'quoteType': 'EQUITY', 'symbol': 'GOOG', 'messageBoardId': 'finmb_29096', 'market': 'us_market', 'annualHoldingsTurnover': None, 'enterpriseToRevenue': 6.452, 'beta3Year': None, 'profitMargins': 0.20798999, 'enterpriseToEbitda': 23.045, '52WeekChange': 0.3901559, 'morningStarRiskRating': None, 'forwardEps': 61.3, 'revenueQuarterlyGrowth': None, 'sharesOutstanding': 329867008, 'fundInceptionDate': None, 'annualReportExpenseRatio': None, 'bookValue': 314.169, 'sharesShort': 2606917, 'sharesPercentSharesOut': 0.0039, 'fundFamily': None, 'lastFiscalYearEnd': 1577750400, 'heldPercentInstitutions': 0.68324995, 'netIncomeToCommon': 35712999424, 'trailingEps': 51.752, 'lastDividendValue': None, 'SandP52WeekChange': 0.16843343, 'priceToBook': 5.6181226, 'heldPercentInsiders': 0.0584, 'nextFiscalYearEnd': 1640908800, 'mostRecentQuarter': 1601424000, 'shortRatio': 1.32, 'sharesShortPreviousMonthDate': 1602720000, 'floatShares': 609554771, 'enterpriseValue': 1107906789376, 'threeYearAverageReturn': None, 'lastSplitDate': 1430092800, 'lastSplitFactor': '10000000:10000000', 'legalType': None, 'lastDividendDate': None, 'morningStarOverallRating': None, 'earningsQuarterlyGrowth': 0.591, 'dateShortInterest': 1605225600, 'pegRatio': 2.09, 'lastCapGain': None, 'shortPercentOfFloat': None, 'sharesShortPriorMonth': 2381334, 'category': None, 'fiveYearAverageReturn': None, 'regularMarketPrice': 1781.18, 'logo_url': 'https://logo.clearbit.com/abc.xyz'}

----------mutualfund_holders-------------

Holder Shares Date Reported \

0 Vanguard Total Stock Market Index Fund 8166693 2020-06-29

1 Vanguard 500 Index Fund 6100848 2020-06-29

2 Growth Fund Of America Inc 3027888 2020-09-29

3 SPDR S&P 500 ETF Trust 3008850 2020-10-30

4 Invesco ETF Tr-Invesco QQQ Tr, Series 1 ETF 2986897 2020-10-30

5 Price (T.Rowe) Blue Chip Growth Fund Inc. 2867378 2020-06-29

6 Fidelity 500 Index Fund 2612122 2020-08-30

7 Vanguard Institutional Index Fund-Institutiona... 2566970 2020-06-29

8 Vanguard Growth Index Fund 2263691 2020-06-29

9 iShares Core S&P 500 ETF 2254397 2020-09-29

% Out Value

0 0.0248 11544518891

1 0.0185 8624219741

2 0.0092 4449784204

3 0.0091 4877375938

4 0.0091 4841789905

5 0.0087 4053354214

6 0.0079 4268677529

7 0.0078 3628694461

8 0.0069 3199976234

9 0.0068 3313061831

----------calendar-------------

Empty DataFrame

Columns: []

Index: [Earnings Date, Earnings Average, Earnings Low, Earnings High, Revenue Average, Revenue Low, Revenue High]

----------option_chain-------------

Options(calls=Empty DataFrame

Columns: [contractSymbol, lastTradeDate, strike, lastPrice, bid, ask, change, percentChange, volume, openInterest, impliedVolatility, inTheMoney, contractSize, currency]

Index: [], puts=Empty DataFrame

Columns: [contractSymbol, lastTradeDate, strike, lastPrice, bid, ask, change, percentChange, volume, openInterest, impliedVolatility, inTheMoney, contractSize, currency]

Index: [])

----------quarterly_cashflow-------------

2020-09-30 2020-06-30 \

Investments -9.372000e+09 -3.011000e+09

Change To Liabilities 7.000000e+08 2.570000e+08

Total Cashflows From Investing Activities -1.519700e+10 -8.448000e+09

Net Borrowings 9.802000e+09 -3.500000e+07

Total Cash From Financing Activities 5.460000e+08 -7.498000e+09

Change To Operating Activities 3.726000e+09 1.367000e+09

Net Income 1.124700e+10 6.959000e+09

Change In Cash 2.387000e+09 -1.902000e+09

Repurchase Of Stock -7.897000e+09 -6.852000e+09

Effect Of Exchange Rate 3.500000e+07 5.100000e+07

Total Cash From Operating Activities 1.700300e+10 1.399300e+10

Depreciation 3.478000e+09 3.367000e+09

Other Cashflows From Investing Activities -4.060000e+08 1.190000e+08

Change To Account Receivables -3.601000e+09 -8.000000e+07

Other Cashflows From Financing Activities -1.359000e+09 -6.110000e+08

Change To Netincome 1.522000e+09 1.340000e+09

Capital Expenditures -5.406000e+09 -5.391000e+09

2020-03-31 2019-12-31

Investments 3.936000e+09 3.370000e+09

Change To Liabilities -7.980000e+08 1.000000e+09

Total Cashflows From Investing Activities -1.847000e+09 -4.703000e+09

Net Borrowings -4.900000e+07 -4.700000e+07

Total Cash From Financing Activities -8.186000e+09 -7.326000e+09

Change To Operating Activities -4.517000e+09 5.481000e+09

Net Income 6.836000e+09 1.067100e+10

Change In Cash 1.146000e+09 2.466000e+09

Repurchase Of Stock -8.496000e+09 -6.098000e+09

Effect Of Exchange Rate -2.720000e+08 6.800000e+07

Total Cash From Operating Activities 1.145100e+10 1.442700e+10

Depreciation 3.108000e+09 3.283000e+09

Other Cashflows From Investing Activities 4.120000e+08 1.210000e+08

Change To Account Receivables 2.602000e+09 -4.365000e+09

Other Cashflows From Financing Activities 3.590000e+08 -1.181000e+09

Change To Netincome 4.465000e+09 1.695000e+09

Capital Expenditures -6.005000e+09 -6.052000e+09

----------recommendations-------------

Firm To Grade From Grade Action

Date

2012-03-14 15:28:00 Oxen Group Hold init

2012-03-28 06:29:00 Citigroup Buy main

2012-04-03 08:45:00 Global Equities Research Overweight main

2012-04-05 06:34:00 Deutsche Bank Buy main

2012-04-09 06:03:00 Pivotal Research Buy main

... ... ... ... ...

2020-07-31 11:44:08 Raymond James Outperform main

2020-08-25 17:05:53 UBS Buy main

2020-10-30 11:38:47 Raymond James Outperform main

2020-10-30 12:38:37 Credit Suisse Outperform main

2020-10-30 17:00:50 Mizuho Buy main

[226 rows x 4 columns]

----------cashflow-------------

2019-12-31 2018-12-31 \

Investments -4.017000e+09 -1.972000e+09

Change To Liabilities 4.650000e+08 1.438000e+09

Total Cashflows From Investing Activities -2.949100e+10 -2.850400e+10

Net Borrowings -2.680000e+08 -6.100000e+07

Total Cash From Financing Activities -2.320900e+10 -1.317900e+10

Change To Operating Activities 7.822000e+09 7.890000e+09

Net Income 3.434300e+10 3.073600e+10

Change In Cash 1.797000e+09 5.986000e+09

Repurchase Of Stock -1.839600e+10 -9.075000e+09

Effect Of Exchange Rate -2.300000e+07 -3.020000e+08

Total Cash From Operating Activities 5.452000e+10 4.797100e+10

Depreciation 1.165100e+10 9.029000e+09

Other Cashflows From Investing Activities 5.890000e+08 5.890000e+08

Change To Account Receivables -4.340000e+09 -2.169000e+09

Other Cashflows From Financing Activities -4.545000e+09 -4.043000e+09

Change To Netincome 7.707000e+09 3.298000e+09

Capital Expenditures -2.354800e+10 -2.513900e+10

2017-12-31 2016-12-31

Investments -1.944800e+10 -1.822900e+10

Change To Liabilities 1.121000e+09 3.330000e+08

Total Cashflows From Investing Activities -3.140100e+10 -3.116500e+10

Net Borrowings -8.600000e+07 -1.335000e+09

Total Cash From Financing Activities -8.298000e+09 -8.332000e+09

Change To Operating Activities 3.682000e+09 2.420000e+09

Net Income 1.266200e+10 1.947800e+10

Change In Cash -2.203000e+09 -3.631000e+09

Repurchase Of Stock -4.846000e+09 -3.693000e+09

Effect Of Exchange Rate 4.050000e+08 -1.700000e+08

Total Cash From Operating Activities 3.709100e+10 3.603600e+10

Depreciation 6.899000e+09 6.100000e+09

Other Cashflows From Investing Activities 1.419000e+09 -1.978000e+09

Change To Account Receivables -3.768000e+09 -2.578000e+09

Other Cashflows From Financing Activities -3.366000e+09 -3.304000e+09

Change To Netincome 8.284000e+09 7.158000e+09

Capital Expenditures -1.318400e+10 -1.021200e+10

----------options-------------

('2020-12-01', '2020-12-04', '2020-12-11', '2020-12-18', '2020-12-24', '2020-12-31', '2021-01-08', '2021-01-15', '2021-02-19', '2021-03-19', '2021-06-18', '2021-07-16', '2021-08-20', '2021-09-17', '2021-10-15', '2022-01-21', '2022-06-17', '2023-01-20')

----------balance_sheet-------------

2019-12-31 2018-12-31 2017-12-31 \

Intangible Assets 1.979000e+09 2.220000e+09 2.692000e+09

Total Liab 7.446700e+10 5.516400e+10 4.479300e+10

Total Stockholder Equity 2.014420e+11 1.776280e+11 1.525020e+11

Other Current Liab 2.215900e+10 1.761200e+10 1.065100e+10

Total Assets 2.759090e+11 2.327920e+11 1.972950e+11

Common Stock 5.055200e+10 4.504900e+10 4.024700e+10

Other Current Assets 4.412000e+09 4.236000e+09 2.983000e+09

Retained Earnings 1.521220e+11 1.348850e+11 1.132470e+11

Other Liab 1.447800e+10 1.653200e+10 1.664100e+10

Good Will 2.062400e+10 1.788800e+10 1.674700e+10

Treasury Stock -1.232000e+09 -2.306000e+09 -9.920000e+08

Other Assets 3.063000e+09 3.430000e+09 3.352000e+09

Cash 1.849800e+10 1.670100e+10 1.071500e+10

Total Current Liabilities 4.522100e+10 3.462000e+10 2.418300e+10

Deferred Long Term Asset Charges 7.210000e+08 7.370000e+08 6.800000e+08

Other Stockholder Equity -1.232000e+09 -2.306000e+09 -9.920000e+08

Property Plant Equipment 8.458700e+10 5.971900e+10 4.238300e+10

Total Current Assets 1.525780e+11 1.356760e+11 1.243080e+11

Long Term Investments 1.307800e+10 1.385900e+10 7.813000e+09

Net Tangible Assets 1.788390e+11 1.575200e+11 1.330630e+11

Short Term Investments 1.011770e+11 9.243900e+10 9.115600e+10

Net Receivables 2.749200e+10 2.119300e+10 1.870500e+10

Long Term Debt 3.958000e+09 3.950000e+09 3.943000e+09

Inventory 9.990000e+08 1.107000e+09 7.490000e+08

Accounts Payable 5.561000e+09 4.378000e+09 3.137000e+09

2016-12-31

Intangible Assets 3.307000e+09

Total Liab 2.846100e+10

Total Stockholder Equity 1.390360e+11

Other Current Liab 5.851000e+09

Total Assets 1.674970e+11

Common Stock 3.630700e+10

Other Current Assets 3.175000e+09

Retained Earnings 1.051310e+11

Other Liab 7.770000e+09

Good Will 1.646800e+10

Treasury Stock -2.402000e+09

Other Assets 2.202000e+09

Cash 1.291800e+10

Total Current Liabilities 1.675600e+10

Deferred Long Term Asset Charges 3.830000e+08

Other Stockholder Equity -2.402000e+09

Property Plant Equipment 3.423400e+10

Total Current Assets 1.054080e+11

Long Term Investments 5.878000e+09

Net Tangible Assets 1.192610e+11

Short Term Investments 7.341500e+10

Net Receivables 1.563200e+10

Long Term Debt 3.935000e+09

Inventory 2.680000e+08

Accounts Payable 2.041000e+09

----------quarterly_financials-------------

2020-09-30 2020-06-30 2020-03-31 \

Research Development 6.856e+09 6.875e+09 6.82e+09

Effect Of Accounting Charges None None None

Income Before Tax 1.3359e+10 8.277e+09 7.757e+09

Minority Interest None None None

Net Income 1.1247e+10 6.959e+09 6.836e+09

Selling General Administrative 6.987e+09 6.486e+09 7.38e+09

Gross Profit 2.5056e+10 1.9744e+10 2.2177e+10

Ebit 1.1213e+10 6.383e+09 7.977e+09

Operating Income 1.1213e+10 6.383e+09 7.977e+09

Other Operating Expenses None None None

Interest Expense -4.8e+07 -1.3e+07 -2.1e+07

Extraordinary Items None None None

Non Recurring None None None

Other Items None None None

Income Tax Expense 2.112e+09 1.318e+09 9.21e+08

Total Revenue 4.6173e+10 3.8297e+10 4.1159e+10

Total Operating Expenses 3.496e+10 3.1914e+10 3.3182e+10

Cost Of Revenue 2.1117e+10 1.8553e+10 1.8982e+10

Total Other Income Expense Net 2.146e+09 1.894e+09 -2.2e+08

Discontinued Operations None None None

Net Income From Continuing Ops 1.1247e+10 6.959e+09 6.836e+09

Net Income Applicable To Common Shares 1.1247e+10 6.959e+09 6.836e+09

2019-12-31

Research Development 7.222e+09

Effect Of Accounting Charges None

Income Before Tax 1.0704e+10

Minority Interest None

Net Income 1.0671e+10

Selling General Administrative 8.567e+09

Gross Profit 2.5055e+10

Ebit 9.266e+09

Operating Income 9.266e+09

Other Operating Expenses None

Interest Expense -1.7e+07

Extraordinary Items None

Non Recurring None

Other Items None

Income Tax Expense 3.3e+07

Total Revenue 4.6075e+10

Total Operating Expenses 3.6809e+10

Cost Of Revenue 2.102e+10

Total Other Income Expense Net 1.438e+09

Discontinued Operations None

Net Income From Continuing Ops 1.0671e+10

Net Income Applicable To Common Shares 1.0671e+10

----------isin-------------

US02079K1079

----------earnings-------------

Revenue Earnings

Year

2016 90272000000 19478000000

2017 110855000000 12662000000

2018 136819000000 30736000000

2019 161857000000 34343000000

Raw data

{

"_id": null,

"home_page": "https://github.com/thorwhalen/invest",

"name": "invest",

"maintainer": null,

"docs_url": null,

"requires_python": null,

"maintainer_email": null,

"keywords": "finance, stock market, trading, markets, python, quant, data",

"author": "Thor Whalen",

"author_email": null,

"download_url": "https://files.pythonhosted.org/packages/a0/41/086cc77c4c2752a8faae8fbed83e95db2491a5d767441e6b6c3cbd30b2f3/invest-0.1.2.tar.gz",

"platform": "any",