| Name | jquants-ml JSON |

| Version |

0.1.4

JSON

JSON |

| download |

| home_page | |

| Summary | jquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above. |

| upload_time | 2023-10-24 13:19:31 |

| maintainer | |

| docs_url | None |

| author | |

| requires_python | >=3.8 |

| license | |

| keywords |

machine learning

python

japanese stock

trade

j-quants

jquants

|

| VCS |

|

| bugtrack_url |

|

| requirements |

No requirements were recorded.

|

| Travis-CI |

No Travis.

|

| coveralls test coverage |

No coveralls.

|

# jquants-ml

[](https://pypi.org/project/jquants-ml/)

[](https://opensource.org/licenses/MIT)

[](https://codecov.io/gh/10mohi6/jquants-ml-python)

[](https://github.com/10mohi6/jquants-ml-python/actions/workflows/python-package.yml)

[](https://pypi.org/project/jquants-ml/)

[](https://pepy.tech/project/jquants-ml)

jquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above.

## Installation

$ pip install jquants-ml

## Usage

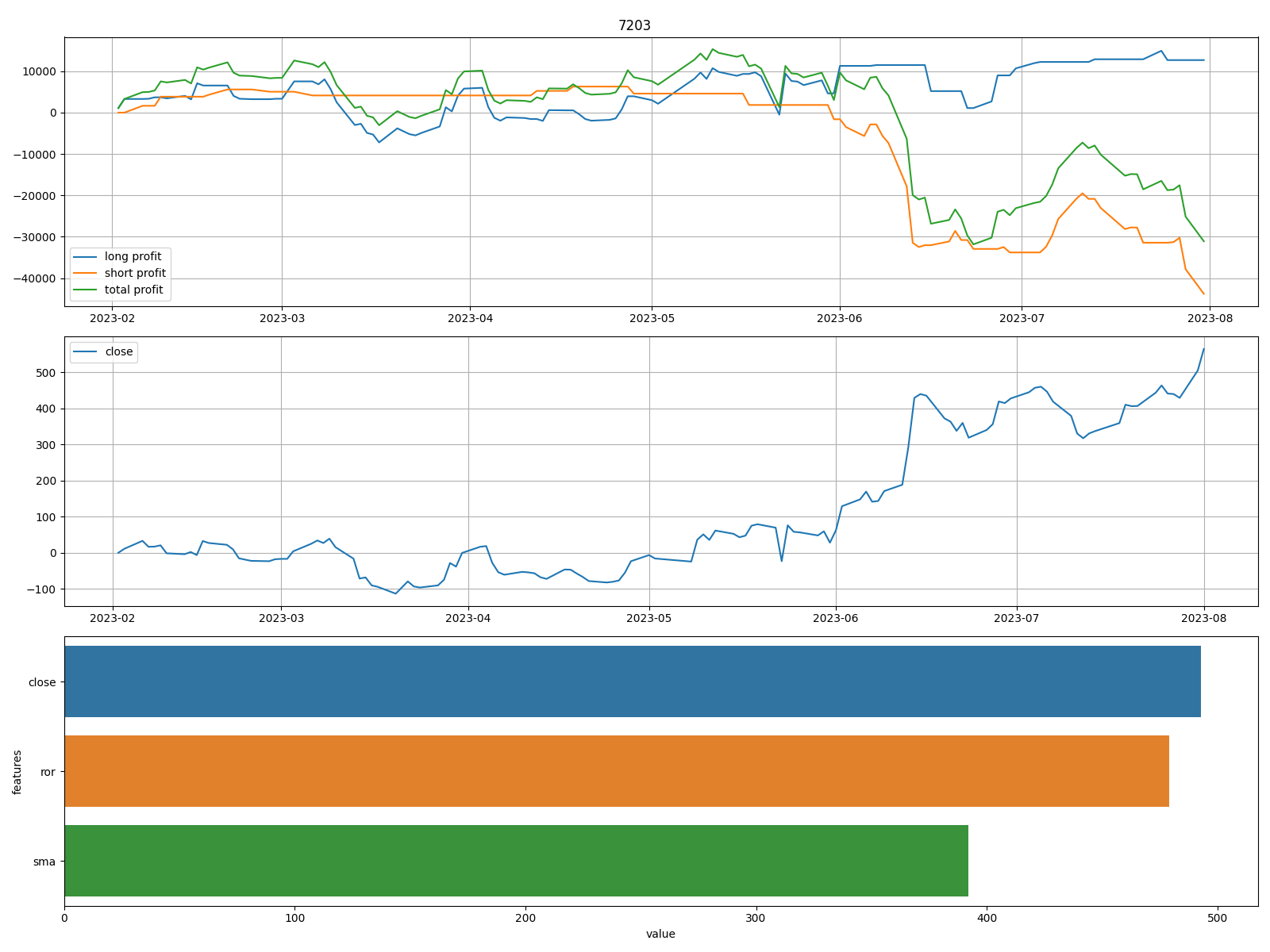

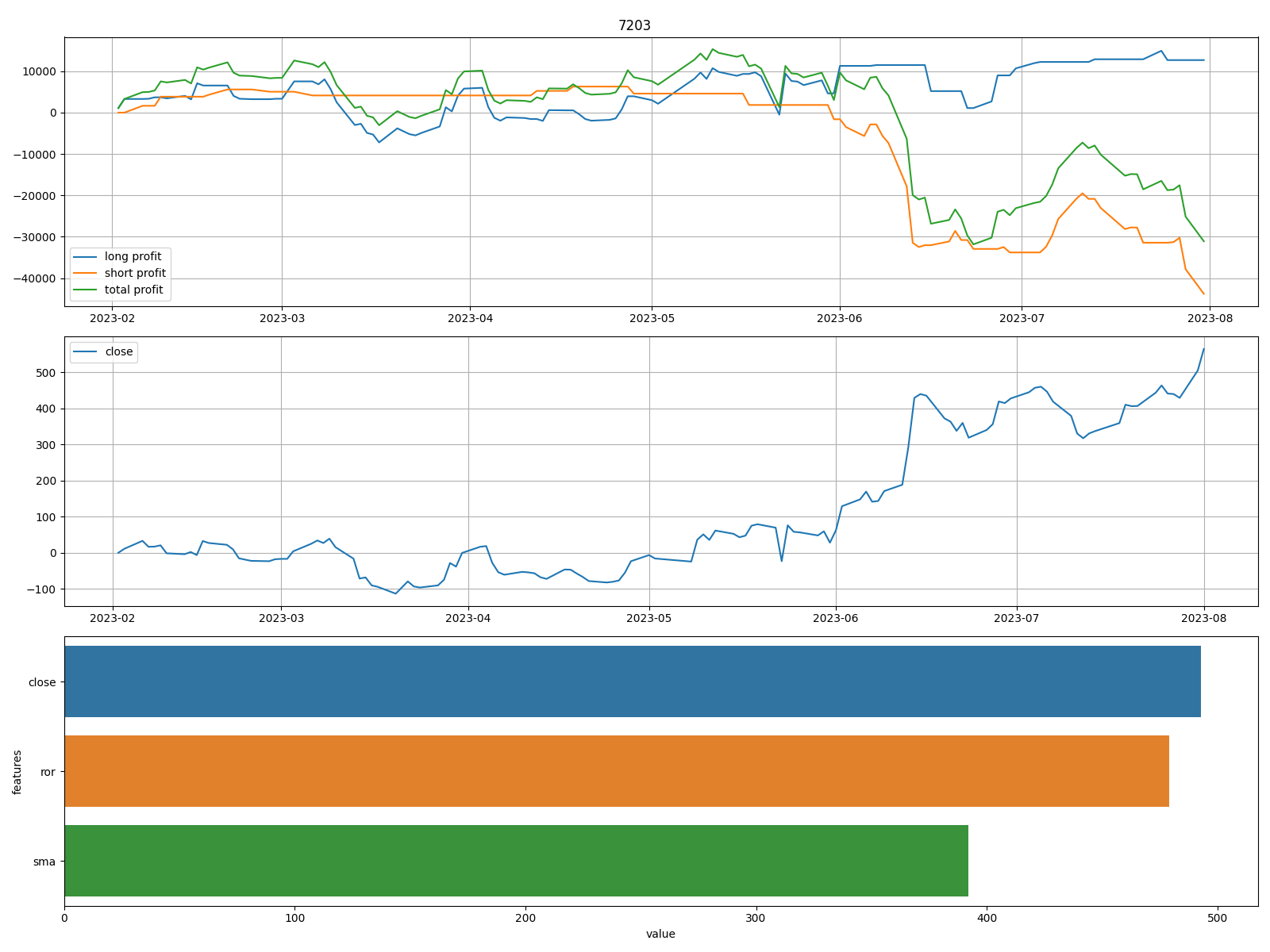

### backtest

```python

from jquants_ml import Ml

import pprint

class MyMl(Ml):

def features(self):

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(ml.backtest())

```

```python

{'long': {'maximum drawdown': '15250.000',

'profit': '12700.000',

'profit factor': '1.183',

'riskreward ratio': '1.213',

'sharpe ratio': '0.063',

'trades': '81.000',

'win rate': '0.494'},

'short': {'maximum drawdown': '50100.000',

'profit': '-43800.000',

'profit factor': '0.413',

'riskreward ratio': '0.478',

'sharpe ratio': '0.298',

'trades': '41.000',

'win rate': '0.463'},

'total': {'maximum drawdown': '47200.000',

'profit': '-31100.000',

'profit factor': '0.784',

'riskreward ratio': '0.837',

'sharpe ratio': '0.149',

'trades': '122.000',

'win rate': '0.484'}}

```

### predict

```python

from jquants_ml import Ml

import pprint

class MyMl(Ml):

def features(self):

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(ml.predict())

```

```python

{'Date': '2023-08-01', 'Price': 2445.5, 'Sign': 'short'}

```

### advanced

```python

from jquants_ml import Ml

class MyMl(Ml):

# Awesome Oscillator

def ao(self, *, fast_period: int = 5, slow_period: int = 34):

return ((self.df.H + self.df.L) / 2).rolling(fast_period).mean() - (

(self.df.H + self.df.L) / 2

).rolling(slow_period).mean()

def features(self):

self.X["ao"] = self.ao(fast_period=5, slow_period=34)

self.X["close"] = self.df.Close

self.X["ror"] = self.df.Close.pct_change(1)

self.X["sma"] = self.sma(period=5)

self.X["ema"] = self.ema(period=5)

self.X["upper"], self.X["mid"], self.X["lower"] = self.bbands(

period=20, band=2

)

self.X["macd"], self.X["signal"] = self.macd(

fast_period=12, slow_period=26, signal_period=9

)

self.X["k"], self.X["d"] = self.stoch(k_period=5, d_period=3)

self.X["rsi"] = self.rsi(period=14)

self.X["atr"] = self.atr(period=14)

self.X["mom"] = self.mom(period=10)

ml = MyMl(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

outputs_dir_path="outputs",

model_dir_path="model",

data_dir_path="data",

)

pprint.pprint(ml.backtest())

pprint.pprint(ml.predict())

```

## Supported indicators

- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Market Momentum 'mom'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

## Getting started

For help getting started with J-Quants, view our online [documentation](https://jpx-jquants.com/).

Raw data

{

"_id": null,

"home_page": "",

"name": "jquants-ml",

"maintainer": "",

"docs_url": null,

"requires_python": ">=3.8",

"maintainer_email": "",

"keywords": "machine learning,python,japanese stock,trade,J-Quants,jquants",

"author": "",

"author_email": "10mohi6 <10.mohi.6.y@gmail.com>",

"download_url": "https://files.pythonhosted.org/packages/29/7f/4d765a6bb8fc8c3269832ae87d7c4ef95146958afcba5277f2b89dcbdea9/jquants-ml-0.1.4.tar.gz",

"platform": null,

"description": "# jquants-ml\n\n[](https://pypi.org/project/jquants-ml/)\n[](https://opensource.org/licenses/MIT)\n[](https://codecov.io/gh/10mohi6/jquants-ml-python)\n[](https://github.com/10mohi6/jquants-ml-python/actions/workflows/python-package.yml)\n[](https://pypi.org/project/jquants-ml/)\n[](https://pepy.tech/project/jquants-ml)\n\njquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above.\n\n## Installation\n\n $ pip install jquants-ml\n\n## Usage\n\n### backtest\n\n```python\nfrom jquants_ml import Ml\nimport pprint\n\nclass MyMl(Ml):\n def features(self):\n self.X[\"close\"] = self.df.Close\n self.X[\"ror\"] = self.df.Close.pct_change(1)\n self.X[\"sma\"] = self.sma(period=5)\n\nml = MyMl(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n)\npprint.pprint(ml.backtest())\n```\n\n\n\n```python\n{'long': {'maximum drawdown': '15250.000',\n 'profit': '12700.000',\n 'profit factor': '1.183',\n 'riskreward ratio': '1.213',\n 'sharpe ratio': '0.063',\n 'trades': '81.000',\n 'win rate': '0.494'},\n 'short': {'maximum drawdown': '50100.000',\n 'profit': '-43800.000',\n 'profit factor': '0.413',\n 'riskreward ratio': '0.478',\n 'sharpe ratio': '0.298',\n 'trades': '41.000',\n 'win rate': '0.463'},\n 'total': {'maximum drawdown': '47200.000',\n 'profit': '-31100.000',\n 'profit factor': '0.784',\n 'riskreward ratio': '0.837',\n 'sharpe ratio': '0.149',\n 'trades': '122.000',\n 'win rate': '0.484'}}\n```\n\n### predict\n\n```python\nfrom jquants_ml import Ml\nimport pprint\n\nclass MyMl(Ml):\n def features(self):\n self.X[\"close\"] = self.df.Close\n self.X[\"ror\"] = self.df.Close.pct_change(1)\n self.X[\"sma\"] = self.sma(period=5)\n\nml = MyMl(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n)\npprint.pprint(ml.predict())\n```\n\n```python\n{'Date': '2023-08-01', 'Price': 2445.5, 'Sign': 'short'}\n```\n\n### advanced\n\n```python\nfrom jquants_ml import Ml\n\nclass MyMl(Ml):\n # Awesome Oscillator\n def ao(self, *, fast_period: int = 5, slow_period: int = 34):\n return ((self.df.H + self.df.L) / 2).rolling(fast_period).mean() - (\n (self.df.H + self.df.L) / 2\n ).rolling(slow_period).mean()\n\n def features(self):\n self.X[\"ao\"] = self.ao(fast_period=5, slow_period=34)\n self.X[\"close\"] = self.df.Close\n self.X[\"ror\"] = self.df.Close.pct_change(1)\n self.X[\"sma\"] = self.sma(period=5)\n self.X[\"ema\"] = self.ema(period=5)\n self.X[\"upper\"], self.X[\"mid\"], self.X[\"lower\"] = self.bbands(\n period=20, band=2\n )\n self.X[\"macd\"], self.X[\"signal\"] = self.macd(\n fast_period=12, slow_period=26, signal_period=9\n )\n self.X[\"k\"], self.X[\"d\"] = self.stoch(k_period=5, d_period=3)\n self.X[\"rsi\"] = self.rsi(period=14)\n self.X[\"atr\"] = self.atr(period=14)\n self.X[\"mom\"] = self.mom(period=10)\n\nml = MyMl(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n outputs_dir_path=\"outputs\",\n model_dir_path=\"model\",\n data_dir_path=\"data\",\n)\npprint.pprint(ml.backtest())\npprint.pprint(ml.predict())\n```\n\n## Supported indicators\n\n- Simple Moving Average 'sma'\n- Exponential Moving Average 'ema'\n- Moving Average Convergence Divergence 'macd'\n- Relative Strenght Index 'rsi'\n- Bollinger Bands 'bbands'\n- Market Momentum 'mom'\n- Stochastic Oscillator 'stoch'\n- Average True Range 'atr'\n\n## Getting started\n\nFor help getting started with J-Quants, view our online [documentation](https://jpx-jquants.com/).\n",

"bugtrack_url": null,

"license": "",

"summary": "jquants-ml is a python library for machine learning with japanese stock trade using J-Quants on Python 3.8 and above.",

"version": "0.1.4",

"project_urls": {

"Documentation": "https://github.com/10mohi6/jquants-ml-python",

"Homepage": "https://github.com/10mohi6/jquants-ml-python",

"Repository": "https://github.com/10mohi6/jquants-ml-python.git"

},

"split_keywords": [

"machine learning",

"python",

"japanese stock",

"trade",

"j-quants",

"jquants"

],

"urls": [

{

"comment_text": "",

"digests": {

"blake2b_256": "ef603f6afcdbca90b8bf491d700523929fb89684e8dd430eb3372cd9df253278",

"md5": "572a060ccd2c328e296a8a3fdcf322c4",

"sha256": "55eb24e0891ac5d26cda397bf30a34281ab47c400e249741de10a868ffc7e1b3"

},

"downloads": -1,

"filename": "jquants_ml-0.1.4-py3-none-any.whl",

"has_sig": false,

"md5_digest": "572a060ccd2c328e296a8a3fdcf322c4",

"packagetype": "bdist_wheel",

"python_version": "py3",

"requires_python": ">=3.8",

"size": 6765,

"upload_time": "2023-10-24T13:19:27",

"upload_time_iso_8601": "2023-10-24T13:19:27.272889Z",

"url": "https://files.pythonhosted.org/packages/ef/60/3f6afcdbca90b8bf491d700523929fb89684e8dd430eb3372cd9df253278/jquants_ml-0.1.4-py3-none-any.whl",

"yanked": false,

"yanked_reason": null

},

{

"comment_text": "",

"digests": {

"blake2b_256": "297f4d765a6bb8fc8c3269832ae87d7c4ef95146958afcba5277f2b89dcbdea9",

"md5": "faa5f7692f086a1b917af027135fc00c",

"sha256": "83241eb992dcf1c80cd1f684b8592ce6409eea0cf6588eecb002d62534081df5"

},

"downloads": -1,

"filename": "jquants-ml-0.1.4.tar.gz",

"has_sig": false,

"md5_digest": "faa5f7692f086a1b917af027135fc00c",

"packagetype": "sdist",

"python_version": "source",

"requires_python": ">=3.8",

"size": 7387,

"upload_time": "2023-10-24T13:19:31",

"upload_time_iso_8601": "2023-10-24T13:19:31.176226Z",

"url": "https://files.pythonhosted.org/packages/29/7f/4d765a6bb8fc8c3269832ae87d7c4ef95146958afcba5277f2b89dcbdea9/jquants-ml-0.1.4.tar.gz",

"yanked": false,

"yanked_reason": null

}

],

"upload_time": "2023-10-24 13:19:31",

"github": true,

"gitlab": false,

"bitbucket": false,

"codeberg": false,

"github_user": "10mohi6",

"github_project": "jquants-ml-python",

"travis_ci": false,

"coveralls": false,

"github_actions": true,

"requirements": [],

"lcname": "jquants-ml"

}