# jquants-algo

[](https://pypi.org/project/jquants-algo/)

[](https://opensource.org/licenses/MIT)

[](https://codecov.io/gh/10mohi6/jquants-algo-python)

[](https://github.com/10mohi6/jquants-algo-python/actions/workflows/python-package.yml)

[](https://pypi.org/project/jquants-algo/)

[](https://pepy.tech/project/jquants-algo)

jquants-algo is a python library for algorithmic trading with japanese stock trade using J-Quants on Python 3.8 and above.

## Installation

$ pip install jquants-algo

## Usage

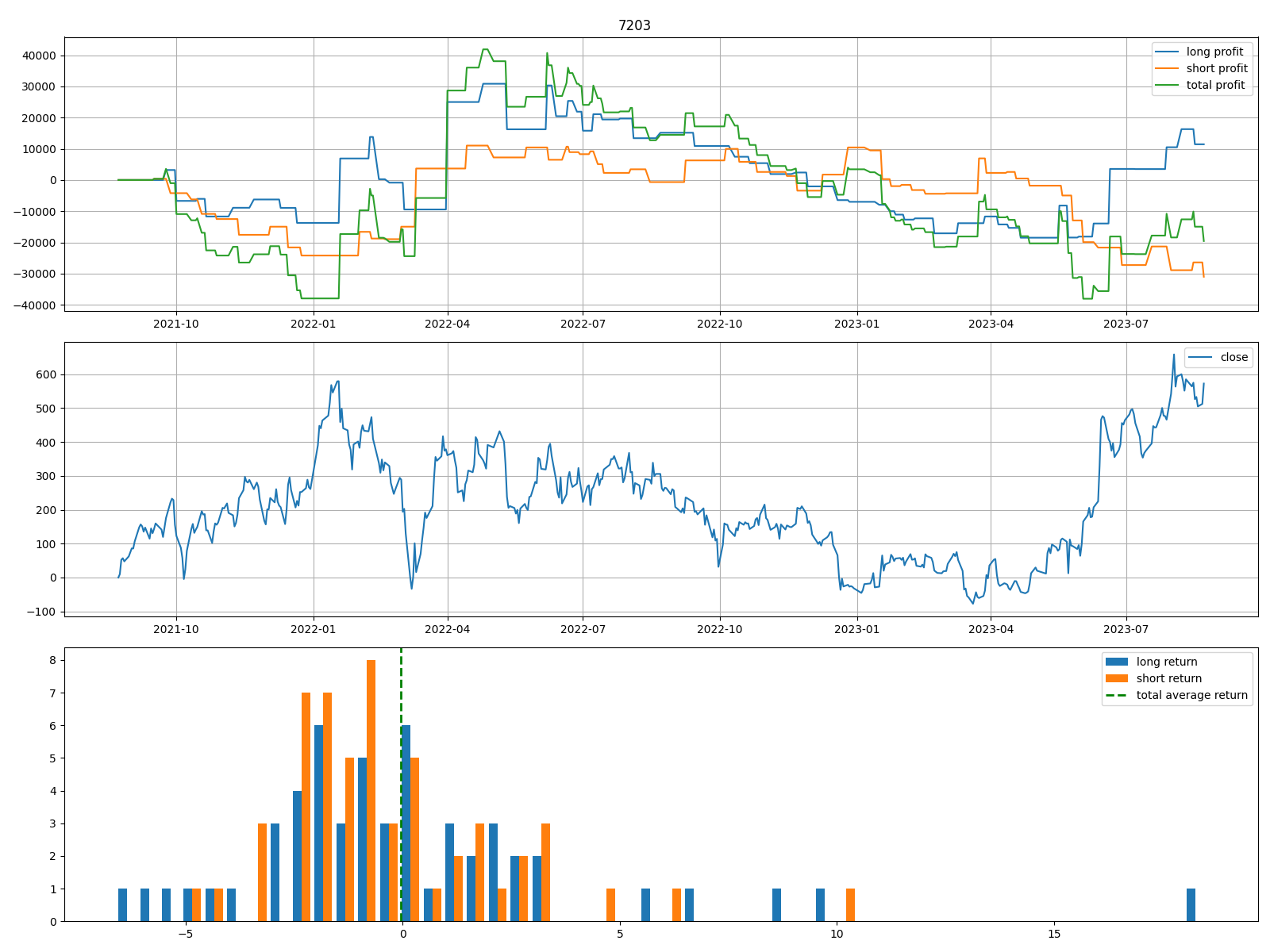

### backtest

```python

from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

fast_ma = self.sma(period=3)

slow_ma = self.sma(period=5)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(algo.backtest())

```

```python

{'long': {'average return': '0.156',

'maximum drawdown': '49350.000',

'profit': '11450.000',

'profit factor': '1.080',

'riskreward ratio': '1.455',

'sharpe ratio': '0.038',

'trades': '54.000',

'win rate': '0.426'},

'short': {'average return': '-0.238',

'maximum drawdown': '42050.000',

'profit': '-31020.000',

'profit factor': '0.754',

'riskreward ratio': '1.319',

'sharpe ratio': '-0.091',

'trades': '55.000',

'win rate': '0.364'},

'total': {'average return': '-0.043',

'maximum drawdown': '79950.000',

'profit': '-19570.000',

'profit factor': '0.927',

'riskreward ratio': '1.423',

'sharpe ratio': '-0.013',

'trades': '109.000',

'win rate': '0.394'}}

```

### predict

```python

from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

fast_ma = self.sma(period=3)

slow_ma = self.sma(period=5)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

)

pprint.pprint(algo.predict())

```

```python

{'buy entry': True,

'buy exit': False,

'close': 2416.5,

'date': '2023-08-22',

'sell entry': False,

'sell exit': True}

```

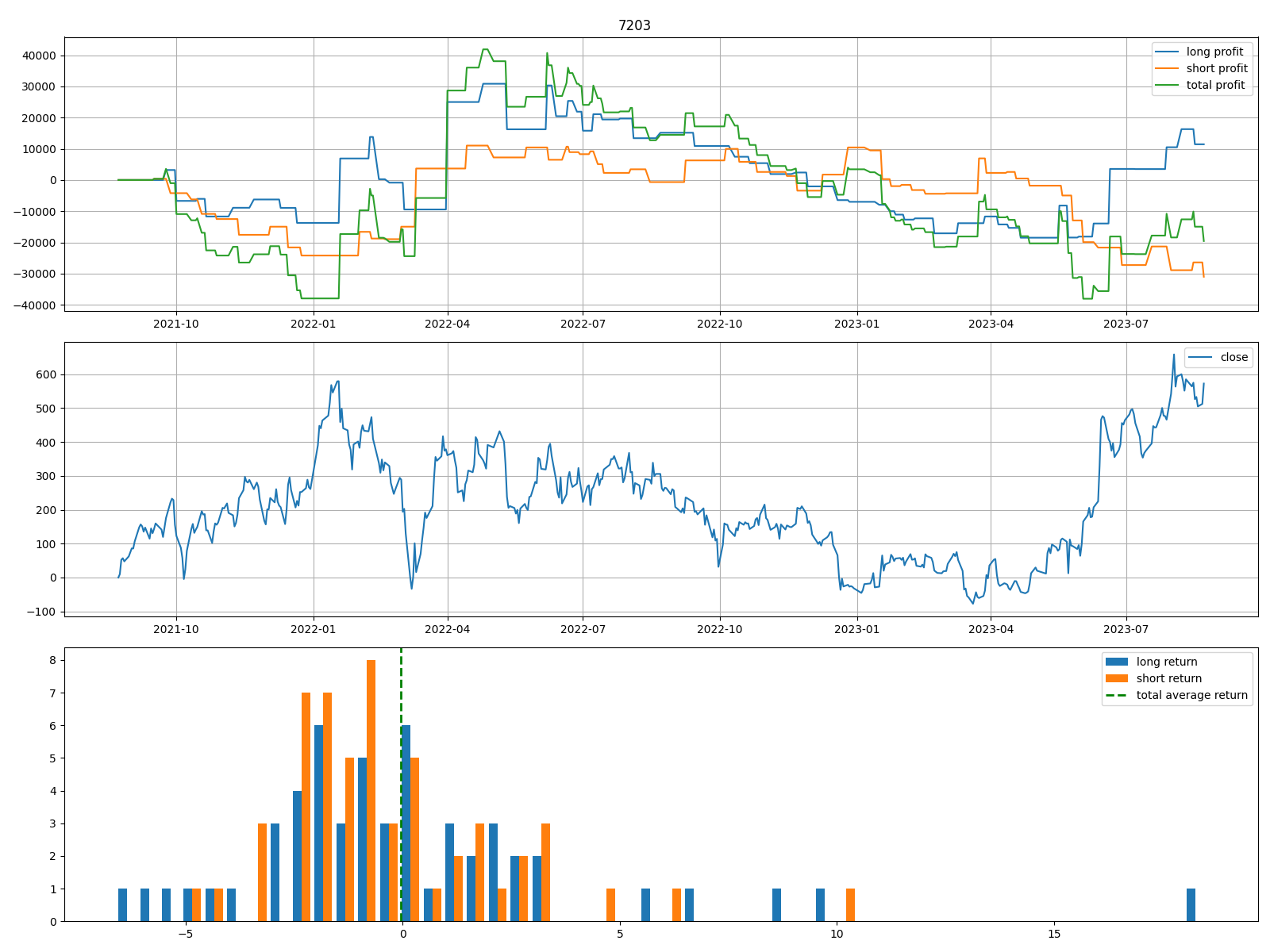

### advanced

```python

from jquants_algo import Algo

import pprint

class MyAlgo(Algo):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

lower = ema - (ema * 0.001)

upper = ema + (ema * 0.001)

self.buy_entry = (rsi < 30) & (self.df.Close < lower)

self.sell_entry = (rsi > 70) & (self.df.Close > upper)

self.sell_exit = ema > self.df.Close

self.buy_exit = ema < self.df.Close

algo = MyAlgo(

mail_address="<your J-Quants mail address>",

password="<your J-Quants password>",

ticker="7203", # TOYOTA

size=100, # 100 shares

outputs_dir_path="outputs",

data_dir_path="data",

)

pprint.pprint(algo.backtest())

pprint.pprint(algo.predict())

```

## Supported indicators

- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Market Momentum 'mom'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

## Getting started

For help getting started with J-Quants, view our online [documentation](https://jpx-jquants.com/).

Raw data

{

"_id": null,

"home_page": "",

"name": "jquants-algo",

"maintainer": "",

"docs_url": null,

"requires_python": ">=3.8",

"maintainer_email": "",

"keywords": "algorithmic trading,python,japanese stock,trade,J-Quants,jquants",

"author": "",

"author_email": "10mohi6 <10.mohi.6.y@gmail.com>",

"download_url": "https://files.pythonhosted.org/packages/8a/60/c09d5145ed65765b529ca3d6bcf60941cc73e0cad05ba09fd02aa4c347f4/jquants-algo-0.1.1.tar.gz",

"platform": null,

"description": "# jquants-algo\n\n[](https://pypi.org/project/jquants-algo/)\n[](https://opensource.org/licenses/MIT)\n[](https://codecov.io/gh/10mohi6/jquants-algo-python)\n[](https://github.com/10mohi6/jquants-algo-python/actions/workflows/python-package.yml)\n[](https://pypi.org/project/jquants-algo/)\n[](https://pepy.tech/project/jquants-algo)\n\njquants-algo is a python library for algorithmic trading with japanese stock trade using J-Quants on Python 3.8 and above.\n\n## Installation\n\n $ pip install jquants-algo\n\n## Usage\n\n### backtest\n\n```python\nfrom jquants_algo import Algo\nimport pprint\n\nclass MyAlgo(Algo):\n def strategy(self):\n fast_ma = self.sma(period=3)\n slow_ma = self.sma(period=5)\n # golden cross\n self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (\n fast_ma.shift() <= slow_ma.shift()\n )\n # dead cross\n self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (\n fast_ma.shift() >= slow_ma.shift()\n )\n\nalgo = MyAlgo(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n)\npprint.pprint(algo.backtest())\n```\n\n\n\n```python\n{'long': {'average return': '0.156',\n 'maximum drawdown': '49350.000',\n 'profit': '11450.000',\n 'profit factor': '1.080',\n 'riskreward ratio': '1.455',\n 'sharpe ratio': '0.038',\n 'trades': '54.000',\n 'win rate': '0.426'},\n 'short': {'average return': '-0.238',\n 'maximum drawdown': '42050.000',\n 'profit': '-31020.000',\n 'profit factor': '0.754',\n 'riskreward ratio': '1.319',\n 'sharpe ratio': '-0.091',\n 'trades': '55.000',\n 'win rate': '0.364'},\n 'total': {'average return': '-0.043',\n 'maximum drawdown': '79950.000',\n 'profit': '-19570.000',\n 'profit factor': '0.927',\n 'riskreward ratio': '1.423',\n 'sharpe ratio': '-0.013',\n 'trades': '109.000',\n 'win rate': '0.394'}}\n```\n\n### predict\n\n```python\nfrom jquants_algo import Algo\nimport pprint\n\nclass MyAlgo(Algo):\n def strategy(self):\n fast_ma = self.sma(period=3)\n slow_ma = self.sma(period=5)\n # golden cross\n self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (\n fast_ma.shift() <= slow_ma.shift()\n )\n # dead cross\n self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (\n fast_ma.shift() >= slow_ma.shift()\n )\n\nalgo = MyAlgo(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n)\npprint.pprint(algo.predict())\n```\n\n```python\n{'buy entry': True,\n 'buy exit': False,\n 'close': 2416.5,\n 'date': '2023-08-22',\n 'sell entry': False,\n 'sell exit': True}\n```\n\n### advanced\n\n```python\nfrom jquants_algo import Algo\nimport pprint\n\nclass MyAlgo(Algo):\n def strategy(self):\n rsi = self.rsi(period=10)\n ema = self.ema(period=20)\n lower = ema - (ema * 0.001)\n upper = ema + (ema * 0.001)\n self.buy_entry = (rsi < 30) & (self.df.Close < lower)\n self.sell_entry = (rsi > 70) & (self.df.Close > upper)\n self.sell_exit = ema > self.df.Close\n self.buy_exit = ema < self.df.Close\n\nalgo = MyAlgo(\n mail_address=\"<your J-Quants mail address>\",\n password=\"<your J-Quants password>\",\n ticker=\"7203\", # TOYOTA\n size=100, # 100 shares\n outputs_dir_path=\"outputs\",\n data_dir_path=\"data\",\n)\npprint.pprint(algo.backtest())\npprint.pprint(algo.predict())\n```\n\n## Supported indicators\n\n- Simple Moving Average 'sma'\n- Exponential Moving Average 'ema'\n- Moving Average Convergence Divergence 'macd'\n- Relative Strenght Index 'rsi'\n- Bollinger Bands 'bbands'\n- Market Momentum 'mom'\n- Stochastic Oscillator 'stoch'\n- Average True Range 'atr'\n\n## Getting started\n\nFor help getting started with J-Quants, view our online [documentation](https://jpx-jquants.com/).\n",

"bugtrack_url": null,

"license": "",

"summary": "jquants-algo is a python library for algorithmic trading with japanese stock trade using J-Quants on Python 3.8 and above.",

"version": "0.1.1",

"project_urls": {

"Documentation": "https://github.com/10mohi6/jquants-algo-python",

"Homepage": "https://github.com/10mohi6/jquants-algo-python",

"Repository": "https://github.com/10mohi6/jquants-algo-python.git"

},

"split_keywords": [

"algorithmic trading",

"python",

"japanese stock",

"trade",

"j-quants",

"jquants"

],

"urls": [

{

"comment_text": "",

"digests": {

"blake2b_256": "8572fd25c87e1500b3abf14221c14f987289b28e9372b596e0b65d318a991a16",

"md5": "100bf231b88c4b3274684fd53b2b717a",

"sha256": "7d0898dbc2f785454ef4c2c920a96ead2f0b9a6678bb7c1a0a001101395e7ef8"

},

"downloads": -1,

"filename": "jquants_algo-0.1.1-py3-none-any.whl",

"has_sig": false,

"md5_digest": "100bf231b88c4b3274684fd53b2b717a",

"packagetype": "bdist_wheel",

"python_version": "py3",

"requires_python": ">=3.8",

"size": 6770,

"upload_time": "2023-11-13T15:21:18",

"upload_time_iso_8601": "2023-11-13T15:21:18.026390Z",

"url": "https://files.pythonhosted.org/packages/85/72/fd25c87e1500b3abf14221c14f987289b28e9372b596e0b65d318a991a16/jquants_algo-0.1.1-py3-none-any.whl",

"yanked": false,

"yanked_reason": null

},

{

"comment_text": "",

"digests": {

"blake2b_256": "8a60c09d5145ed65765b529ca3d6bcf60941cc73e0cad05ba09fd02aa4c347f4",

"md5": "24d9a6dafcad509f8e93b4e7ea8420ae",

"sha256": "d29a6ac0af0c9ec2b53a44c4059f60772575c488fbf7763f5a67bf66f47aa376"

},

"downloads": -1,

"filename": "jquants-algo-0.1.1.tar.gz",

"has_sig": false,

"md5_digest": "24d9a6dafcad509f8e93b4e7ea8420ae",

"packagetype": "sdist",

"python_version": "source",

"requires_python": ">=3.8",

"size": 7344,

"upload_time": "2023-11-13T15:21:20",

"upload_time_iso_8601": "2023-11-13T15:21:20.559353Z",

"url": "https://files.pythonhosted.org/packages/8a/60/c09d5145ed65765b529ca3d6bcf60941cc73e0cad05ba09fd02aa4c347f4/jquants-algo-0.1.1.tar.gz",

"yanked": false,

"yanked_reason": null

}

],

"upload_time": "2023-11-13 15:21:20",

"github": true,

"gitlab": false,

"bitbucket": false,

"codeberg": false,

"github_user": "10mohi6",

"github_project": "jquants-algo-python",

"travis_ci": false,

"coveralls": false,

"github_actions": true,

"requirements": [

{

"name": "certifi",

"specs": [

[

"==",

"2023.7.22"

]

]

},

{

"name": "charset-normalizer",

"specs": [

[

"==",

"3.3.2"

]

]

},

{

"name": "contourpy",

"specs": [

[

"==",

"1.1.1"

]

]

},

{

"name": "coverage",

"specs": [

[

"==",

"7.3.2"

]

]

},

{

"name": "cycler",

"specs": [

[

"==",

"0.12.1"

]

]

},

{

"name": "exceptiongroup",

"specs": [

[

"==",

"1.1.3"

]

]

},

{

"name": "fonttools",

"specs": [

[

"==",

"4.44.0"

]

]

},

{

"name": "idna",

"specs": [

[

"==",

"3.4"

]

]

},

{

"name": "importlib-resources",

"specs": [

[

"==",

"6.1.1"

]

]

},

{

"name": "iniconfig",

"specs": [

[

"==",

"2.0.0"

]

]

},

{

"name": "joblib",

"specs": [

[

"==",

"1.3.2"

]

]

},

{

"name": "jquants-api-client",

"specs": [

[

"==",

"1.5.0"

]

]

},

{

"name": "kiwisolver",

"specs": [

[

"==",

"1.4.5"

]

]

},

{

"name": "matplotlib",

"specs": [

[

"==",

"3.7.3"

]

]

},

{

"name": "numpy",

"specs": [

[

"==",

"1.24.4"

]

]

},

{

"name": "packaging",

"specs": [

[

"==",

"23.2"

]

]

},

{

"name": "pandas",

"specs": [

[

"==",

"1.5.3"

]

]

},

{

"name": "Pillow",

"specs": [

[

"==",

"10.1.0"

]

]

},

{

"name": "pluggy",

"specs": [

[

"==",

"1.3.0"

]

]

},

{

"name": "pyparsing",

"specs": [

[

"==",

"3.1.1"

]

]

},

{

"name": "pytest",

"specs": [

[

"==",

"7.4.3"

]

]

},

{

"name": "pytest-cov",

"specs": [

[

"==",

"4.1.0"

]

]

},

{

"name": "pytest-mock",

"specs": [

[

"==",

"3.12.0"

]

]

},

{

"name": "python-dateutil",

"specs": [

[

"==",

"2.8.2"

]

]

},

{

"name": "pytz",

"specs": [

[

"==",

"2023.3.post1"

]

]

},

{

"name": "requests",

"specs": [

[

"==",

"2.31.0"

]

]

},

{

"name": "scipy",

"specs": [

[

"==",

"1.10.1"

]

]

},

{

"name": "six",

"specs": [

[

"==",

"1.16.0"

]

]

},

{

"name": "tenacity",

"specs": [

[

"==",

"8.2.3"

]

]

},

{

"name": "threadpoolctl",

"specs": [

[

"==",

"3.2.0"

]

]

},

{

"name": "tomli",

"specs": [

[

"==",

"2.0.1"

]

]

},

{

"name": "types-python-dateutil",

"specs": [

[

"==",

"2.8.19.14"

]

]

},

{

"name": "types-requests",

"specs": [

[

"==",

"2.31.0.6"

]

]

},

{

"name": "types-urllib3",

"specs": [

[

"==",

"1.26.25.14"

]

]

},

{

"name": "urllib3",

"specs": [

[

"==",

"1.26.18"

]

]

},

{

"name": "zipp",

"specs": [

[

"==",

"3.17.0"

]

]

}

],

"lcname": "jquants-algo"

}